A number of companies work with natural gas as their base product. Exxon is leaning more and more into chemicals. What I know is that Houston will find a way to keep on growing and the super majors Exxon, Conoco, and others will find a way to survive.

Delmar,

That’s my concern is that the oil majors will not

adapt quickly enough to change and end up going

the way of Sears. If that happens Houston will be

at risk of becoming much less relevant. Kinda like

what happened with Detroit and automobiles. And that could severely hurt UH. OTOH, petrochemicals as you mention will still be needed as best I can tell and there is no substitute for that.

Thanks for posting this article. Sounds like it’s

5 years off still (2025); but at least a fusion machine

at scale is finally being built.

The real battery companies are not American ones. The leaders outside of Tesla are found in Japan. At least two major manufacturing companies are going that direction. Toyota is aiming to have the first totally electrical car out by the Olympics which are happening in 2021.

While it’s true true that natural gas is cheap, the economics of gas power generation still involve the recurring cost of the input fuel to operate. When you look at the lifetime value of a renewable project vs the development of a new fossil fuel plant, the recurring cost of the input fuel over the lifetime of the plant is always a big driver of the valuation.

The thing about the economics of renewables is that while it involves a large upfront cost, it is recouped over time because there are no variable costs related to an input fuel. Due to competition and rapidly advancing innovation, however, the upfront cost to build a new renewable system is falling dramatically, and we are nearing a point where the economics will flip in the favor of renewables. This is what drove a lot of the windfarm development in Texas. The wind tends to blow during the peaks, and its cheaper to source from windfarms than it is to fire up a peaker plant.

We saw how quickly natural gas became the prominent fuel source for generators as the economics pushed things in that direction, and as the economics shift in favor of renewables, there is no reason we shouldn’t expect the same to happen again. Gas fire plants will always be necessary to cover demand peaks…same way we rely on old coal fire plants now…but at some point the majority of our baseload will likely come from a variety of renewable technologies.

I agree it all comes down to economics and that’s been my point. I just don’t think we are very close to that flip. Natural gas is just too cheap right now. JMO

Yeah the key concept is that natural gas is cheap, but the cost to build and maintain renewables is getting cheaper. Ultimately there is a floor in the price of fossil fuel fired electricity because of price of the underlying input commodity. There is no such floor on the rates from renewable generation…especially when you consider the ability to sell excess generation back to the grid.

I get it. Just don’t think we are as close as you do.

Another issue that ties to the original point, you need batteries to store renewables energy. Reliability comes into play here. That said, that will come eventually too.

Renewables (especially solar) keep dropping to where they are more competitive with natural gas plants but as you allude to, the ability to produce a MWh of power any time you want is much more valuable than a MWh you can only get at certain times and that you may not be sure when you get it, even if you can smooth it out with a combination of different sources (batteries, transmission from other places, solar + wind, etc).

Subsidies drove a lot of the wind farm development in TX as well in the form of tax subsidies at the federal level and building transmission lines to get all the power out at a state level.

In states where they are implementing future renewables standards, the price of electricity is going up. It’s not a coincidence.

The conversion to renewables will in part depend on continued improvements in technology and also on political/public will to either subsidize their development and/or consumers and shareholders continuing to get companies to help subsidize their development by paying more for renewable power.

I live in CA and paid an average of $.28 kWh last month. I get 600 kWh at $.24 in the summer and each incremental at $.31. It’s brutal.

There is A LOT of variability in the energy prices even now in TX because there is only so much gas powered generation we can tap into. When consumption peaks in the summer and there are supply shortages, we have to power up old coal fire plants and the prices surge during the peaks. As consumer we don’t see it because the price is averaged out on our bills, but those peaks (and the cost to hedge for them in trading) are built into our rates.

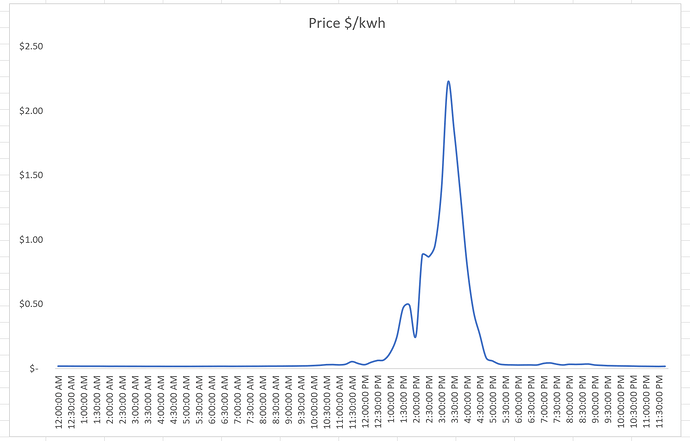

Here’s a cut of a 24 hour price curve in TX (pulled from the ERCOT website and converted to kwh). At the lowest point of the day the real time price of electricity was 2 cents per kwh…at the height of the afternoon peak when consumption is high, the price surges to $2.20 a kwh. This would be considered a bad day in terms of prices, but is pretty typical for an August day in TX.

The thing about solar is that the generation will peak in accordance with demand. So at a macro level if you have enough solar capacity in play, it would actually smooth out the peaks. This is already happening now with the TX wind generation…it hedges the peaks. At a micro/system level, it hedges you against peak consumption, and if you have excess generation, you can sell it to the grid at peak prices. Big issue with solar in TX is that the net metering regulations are (artificially) crippled, so the economics don’t work. But that is a TX regulatory issue.

Batteries are a nice to have, but not a necessity. If a renewable system is not generating enough to power a home, then you just pull from the grid at buy what you need the way you do now. At a grid level, if there is not enough generation coming from renewables, then you fire up a fossil fuel plant to cover.

Renewables don’t involve cutting off fossil fuel generation completely, but it decreases the reliance on it significantly.

Actually it really isn’t if you consider all the real costs to build out those big windmills. Not just the cost of the material but the costs of setting it up, maintaining them and last but not least the actual cost in terms of energy that it takes to make them. The pipelines for natural gas are for the most part already built out. Maintaining them is a lot cheaper than maintaining a windmill that is 1,000 feet high. Don’t get me wrong I love renewable energy and have seen other ideas that make a lot of sense. There is a company in California that has a system of laying a film on the windows of high rise buildings and routing the solar energy to a rooftop generator that would supply electricity to the whole building. Their problem and I have been following them for a decade is that they still don’t understand that they have to sell someone the system to have a showcase for what they say is possible. I see no attempt on their part to do this and until they make that step, they have an idea but no product.

Yes the issue with windfarms is maintenance…particularly the blades. But there has been progress in creating cheaper and more durable blades that will push the recurring costs down.

Solar maintenance is pretty minimal…basically need to have someone clean the panels periodically, and the inverters need to be replaced every ten years or so.

Solar has a lot of promise for homes and commercial buildings because there is a strong correlation between energy consumption and the amount of ambient sunlight outside. Just need to increase the efficiency of photovoltaic cells and find more creative ways of placing them…there are always new concepts being developed. Some will stick in very good ways.

I agree with you on that. I think the big thing for me now is to pick the right solar stocks to buy. The best have gotten really expensive on a per share basis and most of them don’t pay a dividend.

There are too many upstarts. Once solar takes off there will be a lot of consolidation…some will get bought out, others will fail. Some will grow organically. It’s very hard to say who the winners will be.

Also while solar had a lot of upside in the long-term, this election will determine a lot of what happens to solar in the near term.

I don’t think it will. The big companies in this area are ENPH, SEDG, and DQ. DQ makes the solar panels(largest producer in the world and based in China) ENPH does the inverters as does SEDG(based in Israel) The installers are not the companies making the money. Solar is huge in Europe and around the world. The real time changes will not be affected by the election. The essential fact is that Solar is cheaper but has to be aided by natural gas when it is not able to gather and distribute energy. In Morocco they have solar super heat water at the same time it is supplying power during the day and the superheated water gives them an extra two or three hours for power after the sun has gone down before they have to switch to natural gas.