I recently rewatched The Big Short and some of the data suggests it is building again for a repeat. The delinquency in car loans is the next potential domino, with lenders giving such long terms and people underwater on their loans, it may only be a matter of time.

I think many are wrapping themselves in the blanket of overall inflation. The inflation that matters to people who live paycheck to paycheck (which is 70% of Americans) is gasoline, rent, grocery prices and interest rates. Those are the big 4.

There are some in Washington that are bewildered why there is a very pizzed off populace when unemployment is low…well everyone knows how much of their paycheck is leftover.

For you 51; have a read and give me your thoughts on this guys ideas and data he is looking at .

I have heard about the demise of banking for the last 40 years. Banks have been around since the caravans have crossed the deserts. The delivery mechanisms change but banking will always be there.

The numbers of banks will continue to shrink. I don’t know if that is a good thing.

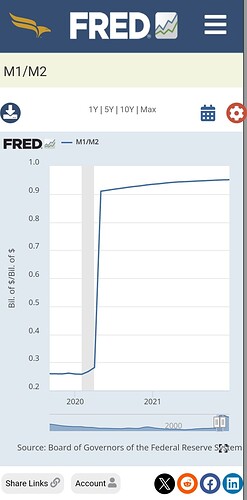

In terms of relevance, banks create money. They will alway be uberly relevant. Most people think the government creates money. The treasury creates currency but banks create money. So there will always be a bank and banking system.

The real risk in the banking system is that bankers don’t understand the products they create. They are amazing at creating something and coming up with cool buzzwords that no one challenges them on, but they (and the regulators) have no idea what they created. The systemic risks tgat were there in 2007 are still there.

He references commercial real estate as a risk…I don’t know about that.

Why do people use that specific bank as any evidence of anything.

It’s simple, that bank used private money to invest in bad investments

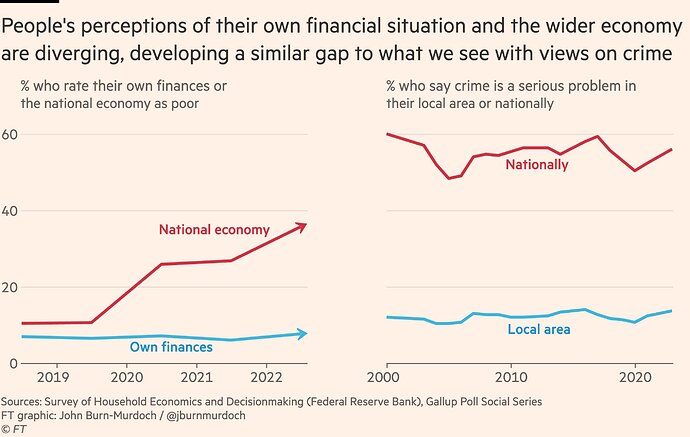

People aren’t really pissed of though as much as they’re reflecting a media narrative that is diverging farther and farther away from reality. Especially when we see in poll after lol how ppl rate their personal financial outlook as good or better but then rate the national outlook as bad or worse.

Just wanted to capture this moment of the Dow

closing above 40,000. Wow ! I can remember

bring shocked when it crossed 10,000 and thought it was overvalued, lol.

Impressive. So is this

Yes. Money has to go somewhere.

It’s the big 7 driving the market, all most all of them are involved in AI in some shape or form.

Separately,

Details from Red Lobster’s bankruptcy filing… $1B in debt, $30m in cash. Previous PE owner sold land and leased it back to Red Lobster at “above market rates”. 5 CEOs in last 5 years…

Sigh.

It’s only 160 million out of 155 Billon in the pension fund. Hopefully, if they are lucky,

they will lose it all in short order before they add to their position. It’s not like

there is no recent history with these type of funds.

I’m not sure I agree with the late Charlie Munger on the government banning these

types of “investments “ , but share his sentiments these are not things the average Joe

investor should be playing with. Buyer beware !

As for Red Lobster, they just need to come up with a new campaign…maybe an

“Endless Lobster” promo this time.

/s

Is the Red Lobster problem a systemic “the economy is broke !” problem or just

really bad management ? Tillman seems to be doing very well lately.

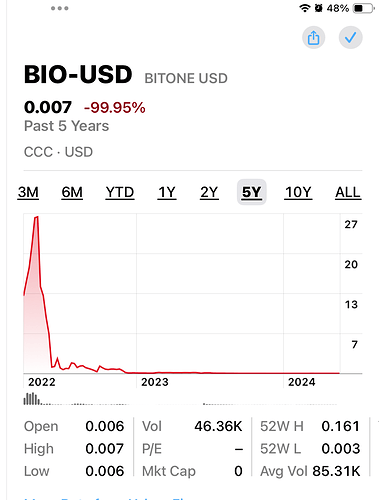

For currency throughout the history of man, he used coconuts, cacao beans, sea shells, lumps of unrefined copper, stones, for currency, hell the Dutch bought Manhattan with trinkets from the Natives. There’s nothing intrinsic about any form of currency including gold it’s the value that man attaches to it. Charlie just did not understand crypto as being a form of storing value and that’s all currency is

Storing value? Give it a rest. Arguing finance with Charlie is the same as arguing theology with God.

Maybe have been your theological money God but he’s was human his feet were are made of clay just like mine and Economist will tell you the simply currency being a store of value, is money 101.But I’ll humbly admit my bank account is not as large as his at his death because you are rich doesn’t mean I bow down at the golden calf of your feet maybe you do, I don’t.

Go out there and sop up all the bitcoin you can bubba! I will continue to follow the tenants of Munger and Buffett

I practice diversified investing that includes crypto, but I got in on crpto back in 2017 and have enjoyed the gains from it. I don’t think it is going away anytime soon.

U.S. is in the process of possibly digitizing the dollar BlackRock amongst several other investment companies have started Bitcoin ETF’s Chase has quietly started offering funds comprised of Bitcoin to their clients.Wells Fargo is investing in Bitcoin. Bitcoin has increasing been accepted by the mainstream as legitimate form of wealth storage and for doing transaction by certain enterprise. I’ve seen Bitcoin ATM’s