New leg of the Bull Market just took off today this markets is a running higher😉

Time to get back to real work.

In the unintentional humor department from Wells Fargo

“Wells Fargo holds employees to the highest standards and does not tolerate unethical behavior,” a company spokesperson said in a statement.

Wells Fargo got the nerve to use the word integrity🤣

Big Picture from Ray Dalio

— don’t have to agree with it but he’s pretty smart…

Based on the lessons I learned from studying history about how things typically transpire under similar circumstances, I believe that what we are now seeing is the (US political) parties increasingly moving to greater extremism and a fight-to-win at all cost mode. This is threatening the rule of law as we know it and is bringing us closer to some form of civil war. (As I will explain below, this is not necessarily a violent conflict, though that is possible).

He lost me after this statement. TLDR

While it is now commonly believed that Trump Republicans are the greater extremists and the Democrats will be moderate, based on how things have transpired in history and what I see today, I’m not so sure.

Dalio has been preaching doom and gloom for several years.

Really smart dude but hasn’t been a great fortune teller over the last decade.

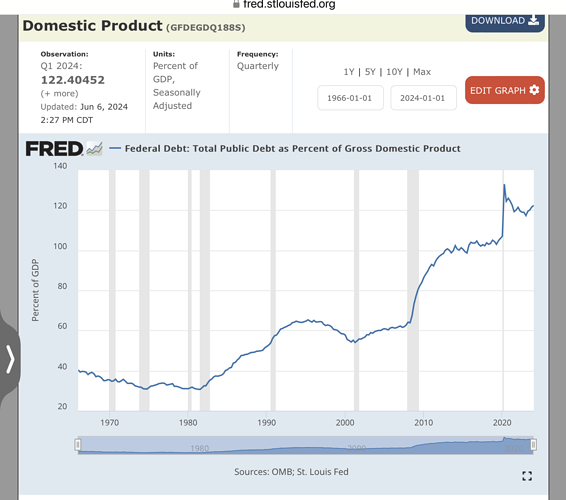

Doom and Gloom is coming because of the federal debt. We are on an unsustainable trajectory.

27T dollar GDP, Debt 34T dollars debt. Ratio is 1.29 large well functioning corporations run much larger debt ratio 's than this. What’s the hullabaloo about. Besides they keep feeding this pablum to the unknowing public, so the fat cats in Washington and their puppet masters can use it as and excuse too cut SS and other social programs that people need This was a stock with this fundamental along with other factors I may buy it.

They just convince everyone that an entire system should be run like your household. And that we can just cut our way out of debt especially cuts for, “those people”

Sure. Look at the top 20 and bottom 20 on this list.Which list you prefer to be in?

https://worldpopulationreview.com/country-rankings/debt-to-gdp-ratio-by-country

Don’t buy into the unsustainable argument or compare it to a personal budget.

Actually, this graph gives you a good look at tecent trend over last 3-4 years.

The interest carry on the federal debt is more than we spend on defense. Plus we have an aging population that is going to put even greater stress on the budget.

Both sides are at fault but I blame the GOP even more because they used to be the party of fiscal conservatism. They don’t cut spending, they just cut taxes for the rich.

The reality is we have to increase taxes on the people that can pay them and we have to cut spending. Primarily in Defense.

Plus you have the moral obligation for paying for your own damn government not having a future generation pay for it. That is absolutely taxation without representation. It the reason we fought a revolutionary war.

The debt is a problem and it obviously is growing by the minute.

I think there is an inflection point but no clue where it is or if we are close to hitting it. We are in uncharted territory already.

The problem is no one wants to use the good economic times to pay for the bad. It’s not popular to campaign on that. But I just can’t imagine this is sustainable forever. I also worry that it’s going to be really hard to pay for the next big issue.

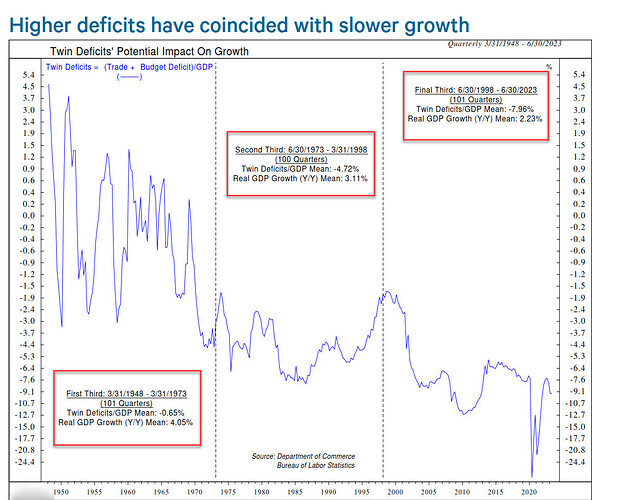

Data back to '48 seem to show Higher Deficits lead to Slower GDP Growth

From 4% GDP growth to 3.1%, & now 2.2% GDP growth

IMO, likely because debt service crowds out investing for growth

See I like this argument much more, that by having massive debt to service we are creating a massive opportunity cost sink where we have to service the debt instead of placing these monies into r the people or projects that could fuel innovation and growth.

What do think of Japan’s debt to GDP ratio ?

There is an inflection point and there is an area

of uncharted territory; but isn’t Japan much further along down that path ?

True, but rates will be set to fall shortly thanks to the economy growth (partly done with inflation) and strong employment.

Scary stuff out there ? Sure, but there always is

something.

Musk just may an announcement the other day that Tesla with his humanoid Robots could be worth 25T dollars someday, think about that 25T not saying his right but I’m sure he’s predicating these numbers based on sales of these robots to industry as well as individuals who want a robot for their own personal use just like a car, he says they"ll sell in the range of 10-20k a piece that’s within reach of the middle class. People don’t seem to understand AI and robotics along with other technological innovation that are being created now this very day and in the future, like space mining asteroids there’s and asteroid out there called 16 Psyche worth and estimated 10 quadrillion dollars in precious metals gold etc. worth enough to make every human being on this planet a billionaire’ many times over. Just imagine the revenue created by these new enterprises that are going to be taxed by the government. We could easily have a 200-300 trillion economy in the not to distant future. People who believe in this debt pablum operate in world of fear and scarcity instead of one of abundance which the universe has plenty of for the asking and for the use of mankind’s benefit.