Fmr. Treasury Secretary Larry Summers: “We’re getting bad news on inflation, and we’re getting bad news on economic strength … confidence in a soft landing is tooth fairy kind of stuff.” https://twitter.com/FreeBeacon/status/1553068324795326464/video/1

Reading Chris’s posts.

correct, I never said unemployment didn’t rise during a recession.

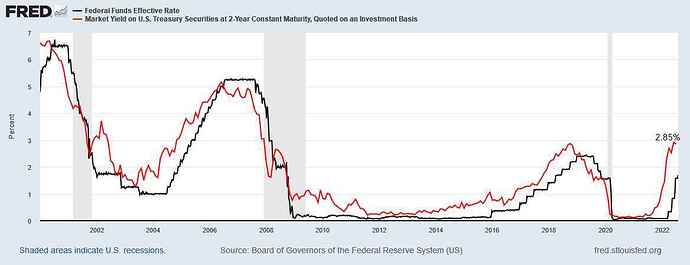

Actually, the inverted yield curve is the fastest. It, again, proved correct. That is. If you think we’ve entered into a recession

Negative GDP quarters isn’t really a predictor. That’s part of the determination.

The yield curve has been an amazing predictor.

These are such unusual times, I’m not sure how reliable any past predictor can be.

That said, I’m still betting on a recession in the future as the Fed’s main focus is

fighting inflation, which I believe to be the wrong medicine at this juncture.

Anyway, fun read from the Fed on negative slope yield curves. From 2018, but

think it’s still relevant.

Agree, I wouldn’t bet on anything.

Rates with a QT turbocharger is scary

Rates with a QT turbocharger is scary

Right, as far as I know, we’ve never done anything like this before ?

Seems like Fed should have started rate increases and/or QT in 2015-2019 time frame.

It happened in 2019 first, but that administration said that it didn’t mean anything. I’ve been waiting on a recession since then. Not sure what happened during 2020 counted and sure doesn’t feel like a recession right now. I’ll treat this like a woman, if you aren’t 100% sure she had an orgasm, she didn’t have one. Businesses are doing great numbers, stock market is rising, no unemployment issues. I wouldn’t be surprised though if the 3rd quarter is positive, then the bottom falls out with a real recession in the 4th quarter. I guess that wouldn’t be a “recession” though for the 2Q in a row only people.

That is not alot of people, the tech industry is huge

True but it’s been a hiring business not a layoff one

With tech having better returns than expected and crypto going up 25% in July, some jobs should come back quick. Crypto losses was the biggest reason for those layoffs. Some of those people may have to move to O&G or other industries who are doing great or are more stable. There was a big layoff surge (across the board) to start 2019 because of certain industry changes and worries about economic slowdown. Anybody talking about a possible recession in 2019 were said to just be doing it out of political reasons.

True, i think most of these layoffs are in tech businesses that ramped up during the pandemic

Which is interesting since we don’t have a liquidity issue. We have supply issues.

Comparing golds effect in relation to a recession from the Great Depression to today’s happening is like comparing Apples to something other than fruit. The US having and keeping the gold standard helped cause the great depression. We aren’t on the gold standard anymore so it matters less and less. It’s value is 15% lower YTD. You read about people investing in gold to hedge against inflation. Looks like they aren’t going that route anymore or at least this time.

Is crypto speculation taking some of that away?

Maybe its just the dollar is strong compared to other currencies?

I think so…

So, I tend to agree , worldwide inflation is mostly supply side.

I’m concerned the rapid interest rate increases may create a liquidity problem too.