In my opinion the Fed is making a huge mistake. As a life long banker I can speak with great certainty that we are not omnipotent. It is the reason we need bailouts every 20 years or so.

Every thing about this economy feels artificial.

In my opinion the Fed is making a huge mistake. As a life long banker I can speak with great certainty that we are not omnipotent. It is the reason we need bailouts every 20 years or so.

Every thing about this economy feels artificial.

I get that feeling too. I’ve got no historical references points for comparison. Things could still

turn into the mother of all recessions or maybe we are on the best path forward. I thought the Feds

actions went too far too fast. And Fed will still keep raising or at least hold steady for next 6 mo I now believe. But if the current data can be trusted ( not meaning a deep state BS take) and can hold up, this may be the best job of economic navigation in history. Just don’t know.

I think raising interest rates helps the retiring baby boomers as they move out of equities and into fixed income securities. They don’t have much debt, so it is a big win for the boomers.

I just don’t see what raising interest rates are going to do. Inflation is in 4 different areas.

labor rates which is due primarily to the labor participation rate dropping because the boomers are retiring

Food prices- that is weather and climate related.

oil prices- which was due to the war and they are coming down.

goods - is due to screwed up supply chains which is Covid and war related,

What is raising rates going to do to inflation, other than it is a baby boomer windfall.

None of the inflation is demand pull, it is supply issues.

None of the inflation is demand pull, it is supply issues

I agree our initial inflation was supply side related. But there

is also the fact 1.5 decades of money being essentially free that

provided some kindling as well. If you choke off demand with interest

rates it will eventually kill inflation, no matter the initial cause, but cause pain for some , just as it always does. Supply side issues are starting to self resolve. Case in point car dealerships now have new inventory.

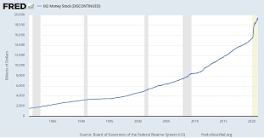

Thanks for that graph…but unless I’m starting to stroke out, it is too blurry to

read . Can you post a link or should I call 911 ?

Thanks !

So M2 money supply hit a peak in mid 2022 at 21.6 Trillion and by November was down to

21.4 or so. The curve slope got steeper around 1995 and even steeper of course with

2020 Covid meds administered to the economy.

So what conclusions do you draw from this, besides the fact a lot of M2 tightening is in the near

term to get us back to pre covid path ?

I appreciate your honesty. They have a pill for that now.

Where I think the M2 argument is wrong is that normally when M2 has grown past its recommended growth limits is due in no small part to Bank Lending being way out of whack. So an increase in interest rates has a natural braking effect in the economy (the cost of borrowing has gone up). M2 is artificially elevated as well because of the stimulus packages. So I don’t think raising interest rates will have any effect on the underlying reasons for inflation.

Now what could happen (and probably will) is that inflation will more or less go down as the supply chains reach equilibrium and the war eventually ends and the Fed will claim victory. It didn’t win the war on inflation, it just naturally subsided. But the raised interest rates will recalibrate asset prices and will be a huge financial win for the retiring baby boomers.

Cough cough…

Inflation normalized 6 months ago…on an annualized basis inflation has been running at just 1.8% since July.

Good thread by Tom (not Tommy) Lee on inflation & the Fed.

Improving stock market seems to agree with Tom’s assessment…

https://twitter.com/fundstrat/status/1613938366734635019?s=20&t=zSbac4fnXowVo5Gc_7SPhQ

The over-arching takeaway over the past month is inflation is falling far faster than most expected - one example former #Treasury Secretary Summers, who is widely followed - only a month ago he said #Fed needs to take rates to 6% - now says ‘Fed closer to done’ (bold added)

Copper price rise looks good for world GDP — it’s widely used so rises & falls in price correlate well…

(Copper chart via Ryan Detrick on Twitter: https://twitter.com/RyanDetrick/status/1613908070677069826)

Big Bird died of bird flu last year…

On a related subject — here’s a real-time estimate of our National Debt —

Screencap here — click to embiggen —

I’ve seen this one before, but forget about it , and then rediscover it again every 5 or 6 years. Thanks.

The world info one on all other things is interesting to watch tick by as well. From energy to tweets, emails sents, births, abortions , deaths by cancer , car fatalities, money spent on illegal drugs, and more.

But their presentation format is not as pleasing as the national debt clock imho.

Numbers rule our lives ![]()

Here’s a good follow on Twitter with a thread on China this week including Evergrande —

https://twitter.com/SofiaHCBBG/status/1616328584377012225

Evergrande… is in restructuring talks with creditors, proposing two options for extending payment deadlines on some USD debt. Separately, auditor PwC quits due to disagreements over Evergrande’s still unpublished 2021 results.

©Copyright 2017 Coogfans.com