From the Capitol Group which runs the American Funds

What the SVB collapse means for investors

March 22, 2023

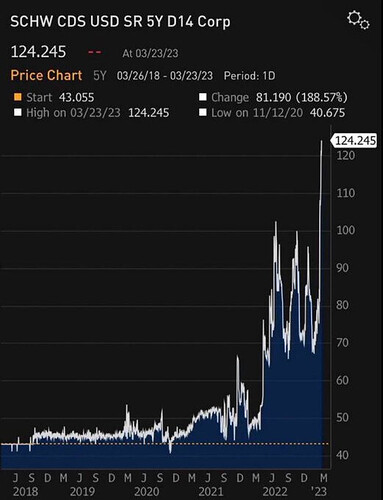

For more than a year, investors have wondered what might prompt the U.S. Federal Reserve to alter its aggressive rate-hiking path. The collapse of SVB Financial, parent company of Silicon Valley Bank, may have provided the answer.

The demise of the 16th largest bank in the United States has dramatically changed the interest rate outlook for the balance of 2023 — and beyond — as the market ponders how the Fed and other central banks will react to growing turmoil in the sector. With fear of contagion spreading, European banks also have come under pressure, forcing regulators to step in and shore up unsteady financial institutions.

Over the weekend, Swiss banking giant UBS agreed to acquire its longtime rival Credit Suisse for more than $3 billion in a deal encouraged by regulators to help restore confidence in the global banking system.

These rapidly unfolding events have led to an environment where the Fed — unquestionably planning to hike rates just two weeks ago — is now tempering its hawkish tone and may even start cutting rates before the end of the year.

On Wednesday, the Fed increased its key policy rate by 25 basis points, but central bank officials omitted language from previous policy statements referring to the need for “ongoing” rate increases. Moreover, a rapid decline in bond yields over the past two weeks means investors expect the Fed to cut rates as expectations for economic growth and inflation fall, says Pramod Atluri, principal investment officer of The Bond Fund of America®.

“The dislocations we are seeing in the financial markets signal a painful new phase for the Fed,” Atluri says. “We knew there would be consequences to one of the most aggressive tightening campaigns in history. It has clearly exposed some vulnerabilities in the banking system and, as a result, we may be nearing the end of the rate hikes.”

SVB collapse has drastically altered interest rate expectations

Sources: Capital Group, Bloomberg Index Services Ltd., Refinitiv Datastream, U.S. Federal Reserve. Fed funds target rate reflects the upper bound of the Federal Open Markets Committee’s (FOMC) target range for overnight lending among U.S. banks. As of intraday, March 15, 2023.

Recession risk on the rise

If investors were expecting a recession this year — and many were — adding a banking crisis into the mix considerably darkens the outlook, says Capital Group economist Jared Franz.

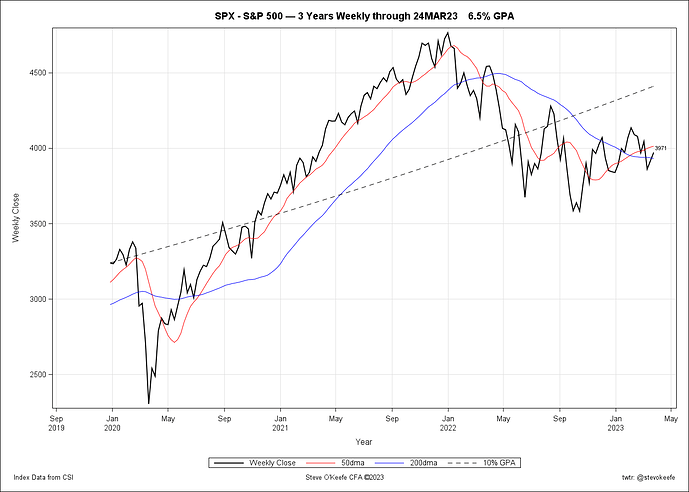

One reason bond yields are falling so quickly is that market participants are now predicting a recession more vociferously than before SVB’s troubles emerged. One strong indicator of that is an inverted yield curve — where the yield on short-term U.S. Treasury bonds is higher than the yield on longer dated bonds.

“That’s the most reliable recession indicator we have,” Franz explains.

Inverted yield curve warns of recession risk

Sources: Capital Group, Bloomberg Index Services Ltd., National Bureau of Economic Research, Refinitiv Datastream. As of March 17, 2023.

Recessions with a banking sector component are generally worse, on average, than more typical downturns, Franz says. That’s because banks will generally tighten lending standards, which then has a knock-on effect for the rest of the economy as it becomes harder for companies and individuals to get financing. Consumer spending and hiring are also likely to be impacted, he adds, as people save more money and companies announce layoffs.

Franz expects U.S. gross domestic product to decline by roughly 1.5% to 2.0% for the full year, compared to a previously expected decline of 1.0%. “That would still be well below the recessionary pain felt during the global financial crisis from 2007 to 2009, when GDP fell 4.3%, which this is clearly not,” Franz stresses.

What about inflation?

The challenge for the Fed is that inflation remains high. On a year-over-year basis, the U.S. Consumer Price Index stood at 6% in February, far above the Fed’s 2% target. That could put pressure on Fed officials to avoid cutting rates too soon. Instead, they may wait to see how much financial conditions tighten in the months ahead should additional turmoil unfold in the banking sector or elsewhere.

“The Fed still has a battle against inflation they need to wage,” Franz explains. “Ironically, the failure of SVB may help Fed officials accomplish their goal of contracting financial conditions so demand falls alongside inflationary pressures.

“We’re only two weeks into this situation, so it’s tough to say how it will ultimately play out. A lot depends on the regulatory response and whether the contagion spreads to other banks. It’s a fluid situation, and I don’t think anybody has all the answers, but hopefully we are asking the right questions.”

Will Robbins, a Capital Group portfolio manager and former banking analyst, remains confident that the overall health of the U.S. banking system is strong. He believes it will simply take time for the turbulence to subside. Regulators have acted swiftly to contain the panic among regional bank investors, he notes, and larger banks have stepped in to help fund the rescue efforts.

“We’ve been here before,” says Robbins, who has covered the banking industry for more than 30 years. “This is an old-fashioned bank run. It’s going to be messy, and it’s going to take a while to sort things out. But I think we are well positioned to get through it.”

Going forward, Robbins expects to see several actions following SVB’s collapse, including a dramatic tightening of lending standards, stricter regulations for small- and mid-sized banks, and a resulting pressure on their ability to generate healthy profits.

“Longer term, I do think the earnings power of smaller banks will be impaired as a result of falling under the same regulatory regime that large banks were subjected to following the financial crisis,” Robbins says. Those included higher capital and liquidity requirements, periodic stress testing and restrictions on the types of investments banks can employ in their bond portfolios. In general, banks with less than $250 billion in assets have been exempt from such regulations.

Regional banks are under the microscope following SVB collapse

Sources: Capital Group, FactSet. Deposit values as of 12/31/2022.

Events are rapidly unfolding, Robbins cautions, so it will be important for investors to continue monitoring the situation.

“Central banks have moved swiftly to try and contain the spread of contagion across the financial system,” Robbins says. “We are still in the thick of it, so we cannot predict the path this will ultimately take.”

[Note: Capital Group’s exposure to certain investments impacted by recent events is available in the right hand column under the “Related resources” category.]

Hear more from Will Robbins:

Is ‘Too Big to Fail’ now a positive?

As with any crisis, this one also presents potential investment opportunities, especially for investors with a long-term horizon.

Large U.S. banks, for instance, are already seeing a massive inflow of deposits as customers switch from regional institutions to the perceived safety of the big four: JPMorgan Chase, Bank of America, Citigroup and Wells Fargo.

Likewise, other large companies with strong balance sheets and the ability to fund their own growth should benefit, relatively speaking, from an environment in which it becomes tougher to access capital markets. Big technology and consumer tech companies from Apple to Amazon could once again find themselves the center of attention if interest rates move significantly lower.

“These are the same companies that did poorly when rates were going up,” Robbins explains. “Now there’s an argument to be made that they are still growing in a low-growth environment. They don’t need access to capital to grow. And in many cases they already funded their major capital investments at a time when the cost of capital was much lower.

“So if there’s an expectation that rates are going down, or at least they aren’t going as high as previously thought,” he continues, “growth-oriented companies could be seen as more valuable, particularly the incumbents that funded their growth years ago.”