Kansas and bit of Oklahoma seem to be epicenter of this years drought at this

point. Band down the middle of country seems possibly developing , including western Texas.

Not “news worthy” at this point maybe ? Of course with ongoing Ukrainian breadbasket problem,

we may see record prices for wheat ? Don’t really know or know how to profit off of this possible scenario.

Experts have wondered about the potential impact of the banking rout lasting for longer. Economist Mohamed El-Erian said economic contagion was possible due to an “erosion of trust” among consumers, and policymakers may not be able to stop it, while Jamie Dimon recently wrote in his annual JPMorgan Chase shareholders letter that he sees the effects lasting for years.

Larry Fink, CEO of asset manager BlackRock, compared the SVB meltdown to a “slow-rolling crisis” like the savings and loan crisis of the 1980s, although the real extent of damage to the financial markets remains unclear in SVB’s case.

“We don’t know yet whether the consequences of easy money and regulatory changes will cascade throughout the U.S. regional banking sector (akin to the S&L crisis) with more seizures and shutdowns coming,” Fink wrote in a letter to stakeholders last month. “It’s too early to know how widespread the damage is.”

So when the money is easy and assets like commercial real estate can be overleveraged, these same lenders/banks and investment firms now cry about it all despite having jumped in with both feet, exacerbating the problems.

Pretty much

Not so bad as one thinks historically speaking. They’re talking about how much lenders make up front processing a mortgage.

“Companies could not adjust their capacity fast enough. The number of production employees declined, but not at the same pace as origination volume"

This is entirely different than them losing money because debtors could no longer pay their mortgages and they were losing money foreclosing on homes that had values well below the amount still owed. When that starts happening…oy…trouble…

Good Chron article on big apartment foreclosure discussed above (paywall)

https://www.houstonchronicle.com/business/real-estate/article/houston-apartment-owner-loses-3-000-units-229m-17891494.php

Loan delinquency rates among apartment owners ticked up slightly recently — with nearly 1.5 percent of apartment communities backed by commercial mortgage securities delinquent in February — but that’s fairly low by historical standards, according to Moody’s Analytics.

Great business model. ![]() Buy cheap, don’t spend anything on maintenance and pocket the rent money.

Buy cheap, don’t spend anything on maintenance and pocket the rent money.

Dude was a slumlord. I feel bad for any investors that didn’t know how he was making profits. Looks like they lost at least $30 million on this deal. Gajavelli probably lost little to nothing personally. There should be a special place in hell for people like him.

Applesway founder Jay Gajavelli did not respond to request for comment, but an online marketing video showed him pitching the benefits of acquiring apartment communities, holding them for a short period and then selling them at profit. Gajavelli said he has worked with more than 300 investors to make passive income after buying more than 20 apartment communities.

“You double your money in three to five years,” Gajavelli said in the video. “This is a very powerful concept and proven business concept.”

It’s not clear when cracks in that model started to appear, but residents of one of the properties owned by Applesway Investment Group and sold April 4 complained to City Council last year about rats, roaches and mold at the Timber Ridge apartment complex located at 12000 Fleming Drive in northeast Houston. Garbage piled up around dumpsters, green water filled one of the pools and the mailroom had fallen into such disrepair that the Postal Service halted mail delivery, they said.

From an excellent investor, Oaktree’s Howard Marks —

https://www.oaktreecapital.com/insights/memo/lessons-from-silicon-valley-bank

The problem is a big problem if Ally starts having issues

More bad news on Autos Loans…

Wells Fargo laying off all junior Auto underwriting staff.

As of 4/27 any auto loans greater than 110% loan-to-value and 15% payment-to-income will be declined.

from https://twitter.com/GuyDealership/status/1648395702169378845

CarDealershipGuy has been reliable but, as always, wait for confirmation from reputable sources on this

Yes, there’s plenty of bad news out there, but…

The S&P 500 has been up 4 of last 5 weeks.

Politicians want to get re-elected so I expect lots of stimulus as '24 approaches.

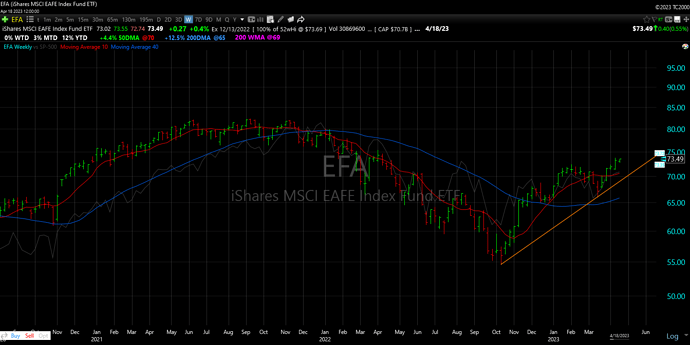

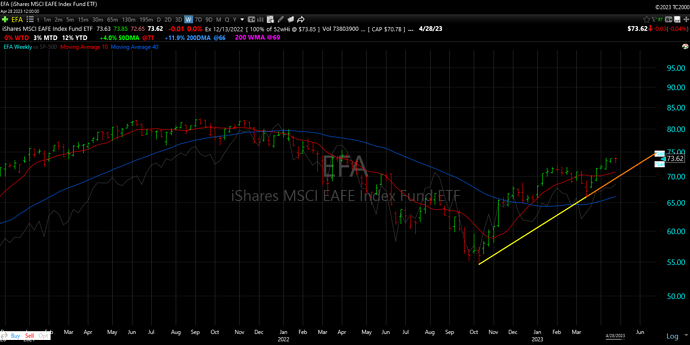

Globally, stocks seem OK, too — see this weekly EFA chart (click to embiggen)

& GE looks strong —

I can make the case [1] the economy bottomed last July with the 2nd Q of negative GDP, [2] the stock market bottomed in October and has been grinding up from there.

Could change, of course, but that’s how it feels to me right now.

Maybe some deals show up?

Dalio is the biggest China whore walking the Earth. Worried you’ll lose your wealth Ray?

Monthly chart of $EWW Mexico ETF breaking out to a 7½-year high

(click to embiggen)

Weekly $EFA strong off the October low — up 35%

(EFA = Europe, Australia, Asia, Far East)

Didn’t know about gold confiscation in 1934. According to my dad, you could pull cash from your life insurance

What is “our” lifetime? I’m almost 50 years younger than her.

She represents the Peter Principle in action