When used properly, credit cards are a really good thing, but amassing credit card debt is not. I charge everything I can on my United Master Card and get points for travel. As a matter of fact, I am going to Hawaii in a couple of weeks on flights paid for with points. But, I pay the entire balance every billing period and incur no interest. I remember when I had credit card debt and it was a weight I had to get rid of.

The article says the average credit card holder has $10,000 in debt on that card. At 20%+ interest, that’s a hefty amount just to stay current.

Just saw a report. Good news, car repo’s are down. Bad news, defaults are still high, its just banks are out of room at the storage lots, so its easier for them to let the defaulters keep the car for now.

Main reason is they can’t get loan value at auction

Well if they bought it new in the last 2 years, they paid out their ass so of course their upside down.

I’ve always wondered how accurate these articles are. My business pays as many bills as possible through the company credit card. I do that to rack up points. I will usually be paying a monthly statement of 20K. When I read these articles I wonder how much that number is skewed by small businesses.

I’ve flown so many flights on travel miles from business credit card purchases I can’t even count them. Seriously, I love that benefit.

My client worked as a consultant at SVB. He called his boss and told him the bank was a mess and wouldn’t last 5 years. His boss said if that if they were in good shape, they wouldn’t need them.

He went on to say he doesn’t see a future for small banks. He also wasn’t a fan of Citi.

Yea, I’m still waiting for the $10/gallon gasoline that some posters had predicted.

Or running out of diesel.

Westfield Group gives up mall in San Fransisco —

Westfield is giving up its namesake San Francisco mall in the wake of Nordstrom’s planned closure, surrendering the city’s biggest shopping center to its lender after foot traffic and sales plunged during the pandemic. The company stopped making payments on a $558 million loan, and Westfield and its partner, Brookfield Properties, started the process of transferring control of the mall at 865 Market St. this month.

Sales plunge during the pandemic. Ha. Here’s a more accurate reason.

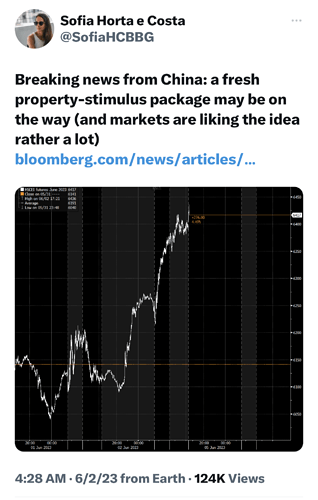

The Nasdaq run up is spec on AI