It is amazing that people who are worried about the stock market do not seem bothered at all that the U.S. no longer makes gunpowder.

I should have stocked up on fireworks

- Is all gunpowder used by the US military manufactured domestically? The goal is to maximize domestic production, but some raw materials or specialized components may be sourced from foreign suppliers. However, the final formulation and manufacturing typically occur within the United States.

One can be worried about both the stock market and where we make gunpowder, etc.

But I’m not worried about where bananas are grown or Nike tennis shoes are made. We need to be more surgical about what we care about in terms of production.

Could you post your source on this information ?

My post is associated with oil markets, not the stock market?

In 2023, about 42% of US households owned at least one firearm, and of those gun owners, a significant portion (66%) own more than one, with 29% owning five or more.

They won’t have to take our guns, they can just take away our ammunition

Just imagine all the home invasions once all the gunpowder in America drys up

Once there is American ammunition again, that’s all you should use for hunting and home protection.

How did we get to a place where we’re killing without American made ammunition?

That your personal prediction or sharing of something you’ve read ?

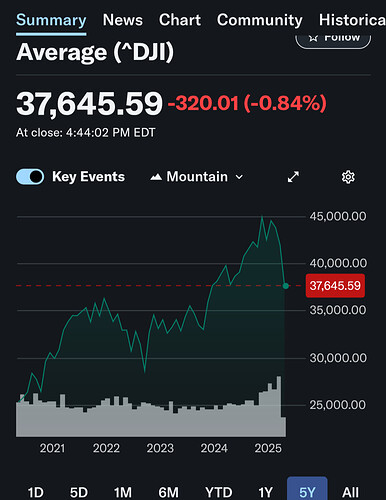

That would be about 15k point drop from the peak of 45k or a solid 1/3

destruction of wealth. FWIW, I tend to agree with that direction , based on

what is being said now. I won’t be quite as pessimistic, but think we will be in the 32k range in 6 months. Sad situation. Investment decisions will be postponed ,

consumers will pull back spending , unemployment will follow, and we are promised roses in 2 years with textile mills your kids or grandkids can work in.

The longer the period of uncertainty goes on ( tariffs, no tariffs, negotiating tariffs,

more tariffs) the more business plans and pullback from investments will be the norm. There comes a point of no return is my fear.

Made my first buy today. Bought some Amazon. It’s down where I bought it last time.

As for “trillions of wealth lost”, it was all paper. We all saw this meteoric rise, especially in the tech sector. I, personally, thought it was terribly inflated. I started taking profits in TSLA, AMZN and WMT before tariffs, Starting to buy back or, at least, consider buying back.

What is surprising is the steep decline in natural gas stocks. I didn’t expect that. Have to look closely to see if worth buying more. I didn’t sell which was a mistake but I hadn’t had huge profits like the techs. Have to study this more.

They are falling with natural gas prices.

The saudis did a big release of reserves. More than expected. Oil has gone into the 50s. Naty gas will drop as well. Will impact those who drill domestically.

Edit: this is stated in the article above regarding oil. It also is why I said I’m happy to be out of oil. Would be another potential layoff threat.

He blinked first. 90 day delay in tariffs.

Except China.

Is that just China or does that include the McDonald’s Islands?

No. It says all countries that didn’t retaliate. 10% staying. EU & Canada retaliated

Who is winning the trade wars?

We are.

Given we blinked….

We blinked and I am not sure we are winning.

Our strategy is just bi-polar fugery of the economy.