No clue what that means - I’d speculate it’s purity/flow not what publicly reported or mineral ownership rights issues. But yes, keep us posted.

And of course best of luck.

Mineral rights.

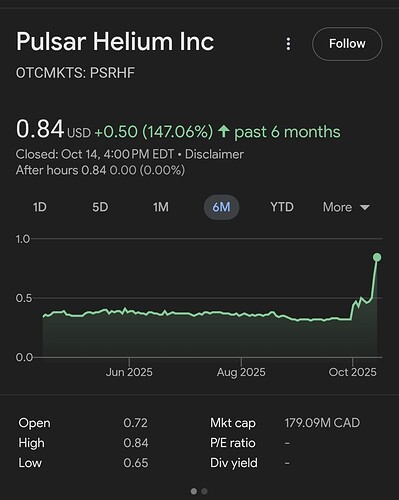

No matter, started to move up

Found this nugget in conversations about Pulsar

H3 is a sideshow, the real action is in H4. Why ? Very likely the US government will fund the whole H3 plant because of critical national needs. The H4 plant already has a commitment from University Bank in Michigan for $12.500.000. They are also a 4.9% stockholder. What people are missing, is the link between the H3 discovery and what it means for the source and size of the regional find of H4. H3 comes from the mantel of the earth. Research that link and you might get bullish yourself.

Spoke to my guy about the issues. It seems most of the land has not had a mineral agreement done in over 50 years and most of the leaseholders aren’t breathing. It will take a long time to track down mineral rights owners which, in turn, slow down drilling opportunities.

It will happen but it may take years to lease the entire 70 square miles.

Sounds like they are proceeding rapidly on what mineral rights are decided.

CASCAIS, Portugal, Oct. 14, 2025 (GLOBE NEWSWIRE) – Pulsar Helium Inc. (AIM: PLSR, TSXV: PLSR, OTCQB: PSRHF) (“Pulsar” or the “Company”), a leading helium exploration and development company, is pleased to announce that the drill rig and supporting equipment has been mobilized and is due to arrive at the Company’s flagship Topaz Project in Minnesota, USA this Wednesday. Up to ten additional wells are to be drilled, with the campaign designed to further define the geometry, extent, and productivity of the helium-bearing reservoir identified in previous drilling and flow-testing campaigns.

Drill depths will be refined based on geological modelling to ensure complete penetration of the reservoir at each location. Operations will run on a continuous 24-hour basis using rotating crews to maximize efficiency and minimize downtime.

I really don’t know how to interpret or understand their long term ( 10 year stock)

performance .

But good luck ! ![]()

Edit - Company link

https://pulsarhelium.com/about/pure-play-helium/default.aspx

Pulsar Helium was incorporated in 2022. Punched up to $.84. I suspect that if this HE play turns out to be very productive, a minerals company will try and buy them.

Right, only been around for about 3 years. Looks like it’s current stock price

is about where its initial public price was, more or less.

It sounds reasonable that it will become the target of a larger mineral

company buying it up. I couldn’t find much from analysts evaluation of

what they think the target price may before these latest announcements.

Should be fun to watch this one play out.

There was no news until recently. I just knew early because of the landman

Well, if your comfortable with all the data out there on this find, it’s possible

there could still be a big run up in the price.

I don’t do speculative or short term investing…but if I did…this may be one to throw some money at.

I took a sum of money for my “gambling” urges and keep away from my nest egg. I use this for more speculative trades. Most I get through the AAII Model Shadow Portfolio which does a lot of homework of small cap stocks. They have an excellent track record but not 100%, I go with trends I see. NGS is a recent example. They supply products to the natural gas industry. I’ve bought shares from 11/23 to 12/24 and currently have a 21% return. I have little doubt it will continue to do well.

Pulsar is strictly a speculative play but based on domestic product shortage, positive initial results it seemed like a worthwhile risk.

Agree; only way I see it going sideways is if the science/tools/methodology Pulsar

uses results in many such plays being found and the commodity price crashes.

That’s probably an unlikely scenario. Like the white hydrogen press a few

years ago, supposedly several reservoirs found, but not sure any are of significant

size and pressure to be commercially feasible - at least that’s the current status

of the white hydrogen thing, best I can determine.

On one hand it’s surprising to think in the whole world there are only 1 or 2 such

helium fields …but on the other hand there is also only one grand canyon.

Unlike hydrogen, helium is not combustible.

Another stock I started buying is Dutch Brothers BROS. They climbed to $86 and then started tumbling for reasons I couldn’t comprehend. It hit $49 and has started going back up. I jumped on at $51. This is a long term growth play with it’s high PE. Yeah, it’s volatile as are most F&B growth stocks

Been a while since I checked in on this. Thanks for the info. Makes sense - Lot has happened in the last few months. The Helium3 is a cherry on top imo. But they also have secured 59,000 acres west of their site ( although different reservoir, so sort of a flyer imo ) and now 6700 acres in Michigan Upper Peninsula which is just on the other side of lake Superior and does seem to be same type of reservoir. Just this morning intermediate update on their new well had it at 1,000 PSI about 4x-5x the pressure on their first 2 wells. Let’s hope your guy makes progress with the mineral rights. I know they are seeking about 25K acres from the state - but state is slowwww

Part of the state’s delay in granting leases is that they’re trying to create a regulatory framework under which to permit and develop. They probably don’t want to issue leases without having some idea of what that framework will look like.

I’ll be interested to see how they approach well spacing, pooling and issues like that. The test wells have all been vertical wells, but I could see them moving to horizontal wells to increase reservoir exposure, depending on geologic factors.

When we were in Phoenix, my buddy said he leased some land in northerm AZ for helium

This is the first time I’ve seen someone attempt to put a value on the Helium (3 & 4, as well as CO2 ) they have… University Bancorp owns 5% of the company and is the one that has committed to $12M financing for the Helium plant so hopefully they know ( to be fair, as part of their Q3 results I am sure they are putting a shine on one of their largest investments ). https://www.cbs42.com/business/press-releases/accesswire/1095871/university-bancorp-3q2025-net-income-4371716-0-85-per-share/ The section on Pulsar is here: • Pulsar Helium (Symbol PSRHF), of which we own 4.999% of the common stock, 7,505,265 shares at an average price per share of $0.45. Pulsar Helium probably has between $42 million to $210 million of Helium-3, an unique resource that is very useful for producing electricity from fusion reactors. While Helium-3 is available on the Moon, Pulsar has the only commercially viable deposit of Helium-3 known on Earth. The estimated range for Helium-4 in its reservoir is in our opinion probably $1 billion to $5 billion. The range for CO2 in its reservoir is probably $0.5 billion to $2.5 billion. All production costs and the cost of separating the gas produced from Pulsar’s reservoir is expected to be offset by the sale of the CO2 to the food processing industry, or to a new use, cooling for AI Data Centers, a superior alternative to using large amounts of water, which is meeting with political resistance. There is a 20% mineral rights royalty payable on all production . Between shares outstanding and options / warrants that are in the money that are expected to be exercised shortly, the company has about 165 million shares outstanding. At the current share price of US$0.581 the market capitalization of the company, which currently has no debt and sufficient cash on hand to get to production in under two years with a project finance loan, is $96 million. The value of the company is probably between $600 million and $3 billion, or $3.64 to $18.18 per share. Of note, at 9/30/2025 our Pulsar Helium shares were marked to market at $0.32 per share, and they closed today at $0.581 per share.

How can that be the case when leases haven’t even been signed yet? That has to just be an assumed number.