Tesla US sales will crater in Q4 as well is my prediction. I think even Musk

alluded to that in his statement of upcoming “few rough quarters”

That’s largely due to his antics from earlier this year.

He put a stain on his brand when EV’s aren’t even supported by the party he was aligning with. Not trying to get political, but there’s a reason he did this → because he knows that if the other side gets in office, then they will implement EV credits that will hurt Tesla.

The market has spoken, Tesla is just a better product. GM, Ford, Toyota don’t have cheaper EVs to offer. They are basically competing at the same price as Teslas best selling models.

Neither does Tesla.

If you’re such a huge fan of EVs, then why not enable the necessary subsidies so that they can scale outside of the upper middle class?

You know what else is highly subsidized? Fossil fuels.

Depends on what market you’re looking at. Market #1 and market #3 are not doing

well for Tesla. Market #2 had some upward movement for Tesla in Q3 but with a rather hefty 49% drop in profit.

Dive Brief:

- Tesla reported a record-high number of deliveries in Q3 of 497,099 vehicles, a 7% year-over-year increase, but its operating profit fell by 40% from $2.7 billion to $1.6 billion, the company reported in its Q3 earnings on Wednesday.

- The carmaker’s Q3 sales were in part boosted by electric vehicle shoppers rushing to beat an expiring tax credit on Sept. 30. Tesla’s YoY automotive revenue increased 6% in Q3 to $21.2 billion, but the jump did not help its bottom line.

- The company cited higher fixed costs per vehicle due to tariffs, lower revenue from the sales of regulatory credits, as well as a decline in Full Self-Driving (FSD) revenue compared to the prior year, for the

Rightly so. Domestic energy supplies are a strategic necessity. I don’t think our military can run on batteries. As we are seeing with rare earth materials, we need to have domestic production.

The average price of a new car is $50k. That’s right around the price of a Tesla model 3 and Y. They are not rich people cars. Tesla sold more than all the other evs combined. Oh no the sky is falling!

You’re right

Damn why aren’t more poor people spending $50K on Teslas?

Gosh poor people are just so stupid and poor

End Citizens United, and I will agree with you

Poor people don’t even buy new ICE cars, they buy used cars. You can pick up a cheap EV used.

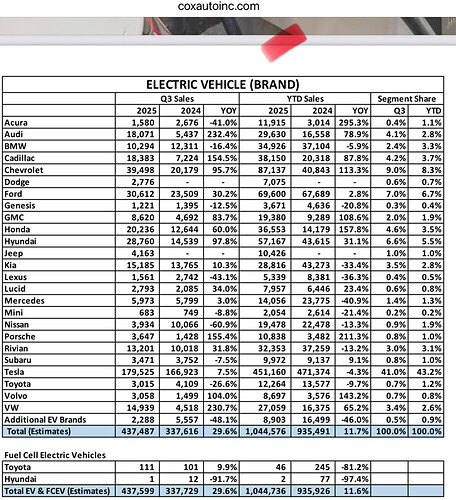

Are we talking about world wide sales? We were talking about the only country that matters, the USA. And in the USA Tesla dominates EV sales by a huge factor.

Go hire a lawyer and do it.

Yes worldwide since they are a global manufacturer.

But yes, if you want to be parochial and only want to consider US, the problem is evident there too. Still the leader but down to mid 40s in latest quarters.

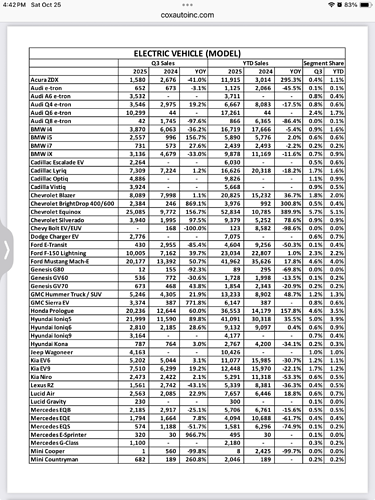

source: Cox Automotive

% EV Market Share By Brand (U.S.)

Automaker Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Q1 2025 Q2 2025

| Tesla | 74.8 | 66.1 | 60.3 | 58.0 | 62.4 | 59.3 | 50.0 | 50.9 | 52.1 | 49.7 | 48.2 | 44.4 | 43.5 | 46.2 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Other EV Sales | - | - | - | - | - | - | - | - | - | - | - | - | 2.0 | 2.0 |

So statement all others combined is false again. The Tesla trend line can only look

good to a Musk fanboy.

Ok it was hyperbole, but if you look at the sheer number of sales, no one in the US is even close. Tesla is a US car manufacturer. In China, Chinese companies dominate, in Germany, European cars dominate. Yes, their market share has decreased, but they are still the best selling EV in the USA buy a wide margin. So look at it anyway you want. The market has spoken, Teslas are still very popular. That probably hurts to hear.

No doesn’t hurt to hear. Why would it ? In the 2nd largest market for autos they are still the best seller. But they’ve went from owning the US market (75% in 2022) to well under 50% in 3 years. That’s the story to me.

And look at the numbers they sold in China. It dwarfs their US sales.

AI Overview

[

In 2024, Tesla sold over 657,000 vehicles in China, setting a new record for the year. For the first nine months of 2025, Tesla’s retail sales in China totaled 432,704 vehicles, a decrease of 5.97% year-on-year.

- 2024 sales:

Tesla sold more than 657,000 vehicles in China, a record high for the year.

Now compare that to other Chinese car makers.

By models, the Y and 3 are still in mix of top ten best sellers in China.

So more of the same story…Tesla dominated at first …but competition

caught up, and future is questionable.

Don’t sleep or ignore what’s happening in China in regards to EV sales and

development. Or auto sales in general. The US is behind in EV adoption and likewise the US EV competitors were just getting started.

But look at their car sales numbers and they are the top dog.

China sells the most cars, with over 25 million sales in 2023, >accounting for 30.2% of all global sales. The United States is the second-largest market, selling 15.4 million cars in the same year.

- China: As the largest global market, China sold approximately 25.1 million cars in 2023, a 1.2% increase from the previous year.

- United States: Coming in second, the U.S. sold 15.4 million cars in 2023.

- Japan: Japan ranked third with 4.5 million sales, a 13.3% increase.

- India: With 4.4 million light vehicles sold, India was the fourth-largest market in 2023.

- Germany: The largest European market, Germany, had 2.8 million sales in 2023.

And as India rises, look for the US to be only the 3rd most important market in auto

sales in next 10-20 years ? That really rattles my cage, but that is the world we will

be living in. Much different then the world I grew up in.

Is this the end of the Ford F150 LIghtning?

Norbert,

You have me really confused because you seem to be a big proponent of EVs, which is great. I am too. I really hope for the sake of aiding in the fight against climate change that we continue to see a rise in EV ownership in the USA.

My confusion is that you’re failing to understand that Tesla is largely ONE OF the reasons that EV ownership in America cannot grow. You’re failing to understand that Tesla does not rely on the subsidies that working-class automobile brands have to rely on.

If you enact more subsidies to support EV manufacturers and thus EV ownership across economic classes, then you will see a large rise in EV ownership surpassing what it is today along with a faster build-out of overall EV infrastructure.

Why are you against this? Especially a self-identified EV supporter yourself. I just don’t understand it.

You can’t tell me that you want the market alone to solve this problem, because as I mentioned prior, fossil fuels is one of the most subsidized industries in the country. That’s technically not “free market” or is it? You tell me.