It was Japan raising rates for the first time since 2007

They did that in the middle of last week. Not saying that’s not having any impact but that isn’t all of it.

That was the spark

Nice buying opportunity and kinda funny watching websites having to change their headlines as the day goes on. Everywhere just like…

'Dow Disaster as it Plummets 1̶1̶0̶0̶ 1̶0̶0̶0̶ 9̶0̶0̶ 8̶0̶0̶ 9̶0̶0̶ 1̶0̶0̶0̶ 9̶0̶0̶ 8̶0̶0̶ 9̶0̶0̶ 1̶0̶0̶0̶ ’

China says “hold my beer”

https://www.wsj.com/finance/are-banks-sweeping-dud-property-loans-under-the-rug-61fd7029

Good old fashion sell off. Market reached full valuation no place to go except down and we do it all I over again when bottom reached. Get yout bargain stocks before there are all gone ![]()

Looks like yesterday was the last day for the flash sale…

Not necessarily. It’s not unusual to have an initial crash, recovery next day, and then a subsequent crash. It’s pretty typical actually.

Not saying that’s going to happen, just that we can’t take too much from today’s recovery.

You’re right if doesn’t make new highs it going to reverse. Buffett pretty much in total cash waiting on the BIG SALE ! So am I

So where are we on the 2nd market crash coming ?

Not meaning to be challenging anyone’s position on it , just curious in today’s world, the timeline when the second shoe would/could/should drop ? 1 week, 2 weeks, etc ?

And what indicators you follow and believe in, if you don’t mind ? Fyi, I’m aware of the big

banks take of the carry unwind( cheap Japan money invested elsewhere ) still in progress…

To be clear, I didn’t say the above because I expected things to get worse. It was more that one rebound day didn’t indicate much.

That said, it seems the market has gotten beyond this scare. The relative stability today is promising. It’s easy to argue things are still overvalued and a correction could come. But the sky is falling seems to have subsided for now (other than those that have been saying that for the last 3 years).

As for indicators, it seems they’ve all broken down the last few years. In any case, I’m a passive investor that doesn’t try to time the market. I’m not interested in losing any fingers trying to catch that falling knife. ![]()

I agree on the true blue indicators being off coming out of a world wide economic shutdown. It was a whole different ballgame. Until things return to normal again. And that’s a second question, when can we get faith back in our old economic analysis tools/indicators. I’m leaning towards

things having pretty much normalized now and pandemic recovery is much less a factor. Except

for moderate world wide inflation that is subsiding.

I understood your initial take on the crash , slight rally, and another crash take theory.

I actually do think there is supporting history of that scenario. But I don’t readily recall how long

bounce-to-2nd drop phases were. I was more curious on when those that do believe in that theory think it may play out.

Some have been stuck on the recession is just around the corner now for many years.

I tend to believe the yen carry activity plus the lower then expected jobs numbers may have accounted for the Monday market drop; but interested in hearing about other ideas out there too to explain it.

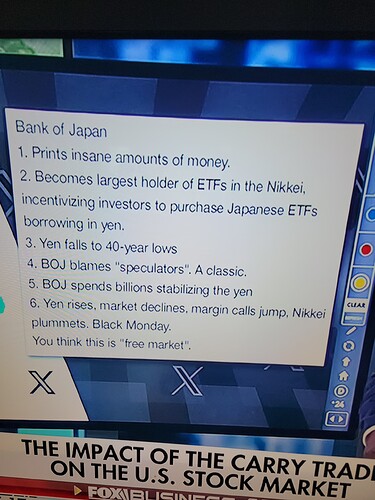

This was today

Harry Dent fits with this comment.

Okay, to summarize Harry, it’s a bubble on top of a bubble , and it will

take 34 mo for this to correct. I think he is saying DJI will go down to

20,000 during this event.

I do think there may be a tech bubble around AI possibly; but still too early imho

to know the true adoption of AI at this version.

We just saw DJI drop from 41,000 to about 38,000 and it’s now back to ~39.000.

So is a ~7% market drop even a crash ?

Hey - eventually they will be right!

Maybe not before early Nov as some may have been hoping, but someday

Nice work.

Just proves Dent is da man !!!

/s

Well he does have the 10 books published with some becoming best sellers, even if

he doesn’t have a history of stellar prediction success.

Harry Dent Net Worth of approximately $6 million, Dent is a celebrated finance author, captivating lecturer, and strategic consultant who has been able to achieve success in all of his endeavours.

What can you say? Pedaling doom and gloom and fear pays well.

I wonder if his net worth is more from his books than his investments. If so, WC Fields is here to say hello.

Apologies if that fact was in the article. Didn’t read it.