Yeah, his source of wealth seems to come from his books per this source. And he’s now worth around 13 million.

It looks like he got stuff right early on which caused people to jump on his bandwagon. He’s pretty much been nothing but wrong with the markets the last 2+ decades though.

The S&P 500 closed at 5,347 last Friday. It closed at 5,344 today.

That’s awesome. With his 1.000 batting average he would have been a Hall of Famer if he had taken up baseball.

What’s Jim Cramer’s advice these days? He’s right so often.

Buy buy buy!

From Twitter:

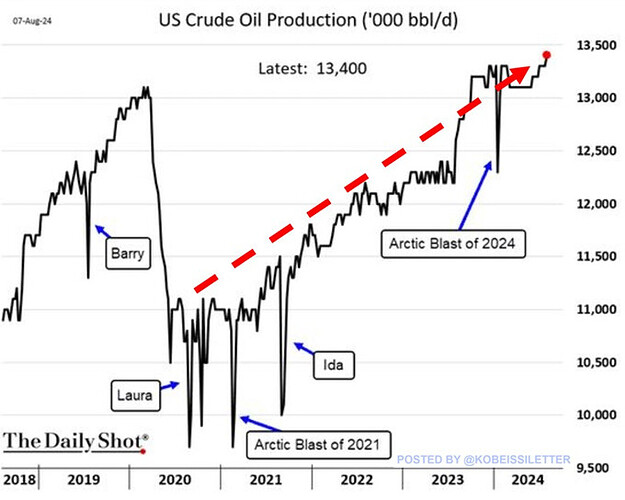

BREAKING: US crude oil production has officially hit a record 13.4 million barrels per day.

Daily oil production has increased by 22% over the last 4 years.

United States Rankings:

- Nominal GDP - Ranked 1st out of 195

- GDP - Ranked 2nd out of 195

- Global Competitive Index - Ranked 2nd out of 195

- Global Innovation Index - Ranked 2nd out of 195

- Total Exports : Ranked 2nd out of 195

- Stock Market Capitalization - Ranked 1st out of 195

- Global Financial Centers - Ranked 1st out of 195

- Military Budget: Ranked 1st out of 195

- Foreign Direct Investment - Ranked 2nd out of 195

Terrible numbers. Such a bad economy

I’m posting this as general life/investing advice — it’s not related to anything specific in this thread.

I recently saw some mentions on X/Twitter of famous investor Charlie Munger saying to avoid victimhood mentality so I prompted X’s Grok 2.0 with “Charlie Munger on avoiding victimhood” and I like the reply. I hope y’all find it helpful, too.

begin @Grok —

Charlie Munger, known for his sharp wit and profound insights, especially in the realm of investing and life philosophy, has often spoken about the dangers of adopting a victim mentality. Here’s how Munger’s views on avoiding victimhood can be summarized:

-

Self-Responsibility: Munger emphasizes that feeling like a victim is one of the most destructive mindsets one can have. He famously stated, “Whenever you think that some situation or some person is ruining your life, it’s actually you who are ruining your life.” This perspective encourages taking responsibility for one’s own life, suggesting that even in the face of adversity, one’s reaction to it largely determines the outcome.

-

Avoiding Self-Pity: Munger warns against self-pity, which he sees as closely related to victimhood. He believes that self-pity can lead to paranoia, making it one of the hardest mental states to reverse. His advice is to not let oneself drift into this mode of thinking because it’s counterproductive.

-

Constructive Use of Adversity: Instead of wallowing in misfortune, Munger advocates for using every missed chance or setback as an opportunity for learning and growth. This approach transforms what might be seen as negative experiences into valuable lessons or stepping stones for personal development.

-

Long-Term Thinking and Patience: Munger’s philosophy often touches on the importance of patience and long-term thinking, not just in investing but in life. He suggests that waiting, enduring, and not succumbing to immediate despair or blame are key to overcoming challenges without feeling victimized.

-

Avoiding Envy and Resentment: He also speaks against envy, which can be seen as a form of victimhood where one feels disadvantaged by others’ success. Munger points out that envy is a sin where you can’t possibly have any fun, indicating its futility and the importance of focusing on one’s own path.

-

Life Lessons from His Own Experiences: Munger’s personal life, including his approach to dealing with potential blindness, reflects his philosophy. He prepared to face life’s challenges head-on, not as a victim but as someone who would adapt and continue to contribute, showing that one’s attitude towards life’s hardships can define their experience of life.

From posts on X and various quotes, it’s clear that Munger’s advice on avoiding victimhood is not just theoretical but deeply ingrained in his life’s approach:

- Direct Quotes and Sentiment: X posts and other sources reiterate Munger’s stance against victimhood, with sentiments like “I never saw any good become of feeling like a victim,” underscoring his belief in personal agency and resilience.

Charlie Munger’s teachings on this subject serve as a reminder that while we cannot control all external events, we can control our reactions to them. His philosophy encourages a proactive, resilient, and forward-thinking approach to life, steering clear of the pitfalls of victimhood.

— end @Grok

Search[

Menu

](javascript:![]()

Oil and petroleum products explainedOil imports and exports

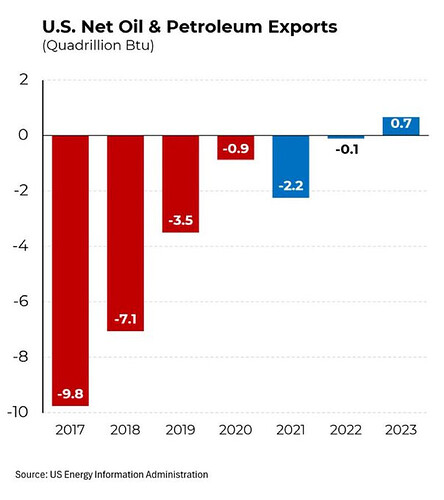

The United States became a total petroleum net exporter in 2020

In 2020, the United States became a net exporter of petroleum for the first time since at least 1949.1 In 2022, total petroleum exports were about 9.52 million barrels per day (b/d) and total petroleum imports were about 8.33 million b/d, making the United States an annual net total petroleum exporter for the third year in a row. Total petroleum net exports were about 1.19 million b/d in 2022. Also in 2022, the United States produced2 about 20.08 million b/d of petroleum and consumed3 about 20.01 million b/d. Although U.S. annual total petroleum exports were greater than total petroleum imports in 2020, 2021, and 2022, the United States still imported some crude oil and petroleum products from other countries to help to supply domestic demand for petroleum and to supply international markets.

The United States remained a net crude oil importer in 2022, importing about 6.28 million b/d of crude oil and exporting about 3.58 million b/d. Some of the crude oil that the U.S. imports is refined by U.S. refineries into petroleum products—such as gasoline, heating oil, diesel fuel, and jet fuel—that the U.S. later exports. Also, some of imported petroleum may be stored and later exported.

U.S. petroleum imports peaked in 2005

After generally increasing every year from 1954 through 2005, U.S. gross and net total petroleum imports peaked in 2005. Since 2005, increased domestic petroleum production and increased petroleum exports have helped to reduce annual total petroleum net imports.

U.S. petroleum consumption, production, imports, exports, and net imports, 1950-2022

Line chart with 5 lines.

An interactive line chart showing amounts of U.S. annual petroleum consumption, production, imports, exports, and net imports in 1950 through 2022.

The chart has 1 X axis displaying values. Data ranges from 1950 to 2022.

The chart has 1 Y axis displaying million barrels per day. Data ranges from -1.26 to 20.802.

million barrels per dayU.S. petroleum consumption, production,imports, exports, and net imports, 1950-2022consumptionproductionimportsexportsnet imports19501960197019801990200020102020-4-20246810121416182022Data source: U.S. Energy Information Administration, Monthly EnergyReview, Table 3.1, September 2023

End of interactive chart.

Shares of U.S. petroleum imports from OPEC and Persian Gulf countries have declined, and the share of imports from Canada has increased

U.S. petroleum imports rose sharply in the 1970s, especially from members of OPEC. In 1977, when the United States exported relatively small amounts of petroleum, OPEC nations were the source of 70% of U.S. total petroleum imports and the source of 85% of U.S. crude oil imports.

Since 1977, the percentage shares of U.S. total petroleum and crude oil imports from OPEC countries have generally declined. Saudi Arabia, the largest OPEC petroleum exporter to the United States, was the source of 7% of U.S. total petroleum imports and 7% of U.S. crude oil imports. Saudi Arabia is also the greatest source of U.S. petroleum imports from Persian Gulf countries. About 12% of U.S. total petroleum imports and 12% of U.S. crude oil imports were from Persian Gulf countries in 2022.

U.S. petroleum imports: total, and from OPEC, Persian Gulf, and Canada, 1960-2022

Line chart with 4 lines.

An interactive line chart showing amounts of U.S. annual total petroleum imports, and from OPEC, Persian Gulf, and Canada in 1960 through 2022.

The chart has 1 X axis displaying values. Data ranges from 1960 to 2022.

The chart has 1 Y axis displaying million barrels per day. Data ranges from 0.12 to 13.714.

million barrels per dayU.S. petroleum imports: total, and fromOPEC, Persian Gulf, and Canada, 1960-2022totalOPECPersian GulfCanada19601965197019751980198519901995200020052010201520200.01.02.03.04.05.06.07.08.09.010.011.012.013.014.0Data source: U.S. Energy Information Administration, Monthly EnergyReview, Tables 3.3a, 3.c, and 3.3d, September 2023

2018

▬ total: 9.94 million barrels per day

▬ OPEC: 2.89 million barrels per day

▬ Persian Gulf: 1.58 million barrels per day

▬ Canada: 4.29 million barrels per day

End of interactive chart.

Petroleum imports from Canada have increased significantly since the 1990s, and Canada is now the largest single source of U.S. total petroleum and crude oil imports. In 2022, Canada was the source of 52% of U.S. gross total petroleum imports and 60% of gross crude oil imports.

Just hope we don’t have another blowout catastrophic spill (with this new and improved technology always improved until it fails)like what happened with BP polluting the Gulf years ago…

FLASH SALE! Is over folks. Missed your chance just wait another one is coming. ATTENTION ALL SHOPPERS BLUE LIGHT SPECIAL WALLSTREET aisle 10