I’ve only moved money in and out via chase which I do often (usually automatically).

Bet it all on HUSA

@coachv has posted about the fall of used car prices. Tesla is getting caught up in that, too. As much as coachv and I disagree about nearly everything, I’m happy to post something showing my friend had this part figured out a while ago. TSLA after hours hit $106.

Tax-loss harvesting contributing to TSLA’s selloff, IMO — Be interesting to see if there’s a big bounce as we roll into a new year

https://twitter.com/bespokeinvest/status/1608088403157094402

That’s certainly part of it , but it’s still pricey with PE . Is Tesla just a car company or high tech

company has been often discussed thing in the media. I think it will fall below $100 and I don’t

see a rebound until Musk gets his and his engineers heads out of twitter and into tesla.

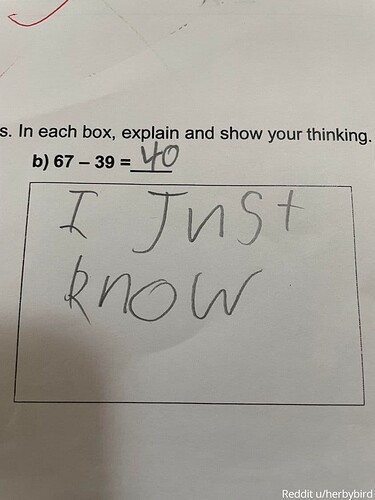

Had that issue with my son. He’d do algebra in his head and never show his work.

Impressive early Nov. technical analysis by Peter Brandt with a $104 TSLA target

He’s a pretty good technician, IMO, & worth a follow

https://twitter.com/PeterLBrandt/status/1589655299480506370

… and see Peter’s twitter today for $AAPL chart

Lots of folks bought cars at peak prices. Now they are underwater. Lenders don’t want to repo as their balance sheet will turn negative. Mexican standoff.

Nailed it!

Back to China…

Good analysis, IMO, by Tom —

For 2023, we have the bullish force of the third year of a presidential term being met by the bearish forces of Fed rate hikes AND Fed QT. If ever there were a condition under which the bullish tendency of the third year might not work, this is that time.

Blackstone seems desperate guaranteeing 11.25%

Gosh, this recession is just terrible…

I agree with you that this economy has all the economists scratching their heads. One thing that you have to keep in mind when you look at the low unemployment rates is the labor force participation rate. If you look at this chart it is the story of the baby boomers. The baby boomers and women joined the labor force in great numbers starting about 1965 and peaked around 2000 and has been going down ever since as the Baby Boomers are retiring. It dropped a great deal in covid and came back.

But the point is we are going through huge structural and demographic changes that no one really knows what is going on in the economy.

Labor Force Participation Rate (CIVPART) | FRED | St. Louis Fed (stlouisfed.org)

I agree with you that this economy has all the economists scratching their heads

Everything you know, all the truest of blue indicators, and all the historical economical graphs

are all a wee bit off due to the world wide pandemic and economic engine pauses and shutdowns.

We are in uncharted waters. And while it looks like a reasonable landing is possible, at some point

the Fed actions will start to choke off growth of inflation and jobs.