They seem to have been on a long time downward slope

stock wise for last 10 years. Others in this sector seem

to be benefiting from YELL demise. Still 30k jobs is a lot.

Tale of the tape: Gainers in the trucking sector on Wednesday included Yellow Corporation (YELL) +8.25%, ArcBest Corporation (ARCB) +6.09%, Old Dominion Freight Line (ODFL) +6.07%, Saia (SAIA) +4.90%, TuSimple (TSP) +4.85%, Daseke (DSKE) +4.51%, XPO (XPO) +4.40%, TFI International (TFII) +3.25%, and Knight-Swift Transportation (KNX) +2.77%. Over the last four weeks, the biggest advancers amid the Yellow developments have been ArcBest (ARCB) +37%, XPO (XPO) +33%, SAIA (AIA) +29%, Old Dominion Freight Line (ODFL) +25%, and Covenant Logistics Group (CVLG) +16%.

In perspective , $75 billion isn’t much. They may need to pay more competitive interest

rates if they want to hold onto corporate cash.

New numbers show the amount of cash deposits at JPMorgan’s corporate and investment bank fell by $75 billion in the second quarter of 2023, reports the Financial Times.

That’s a loss of 10% from one year prior.

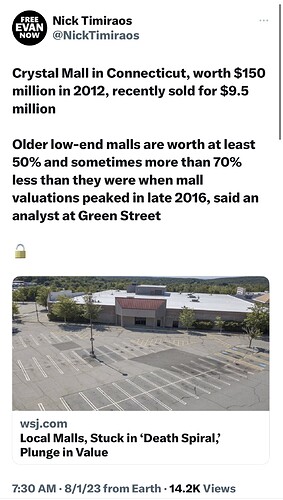

Sometimes malls are in the right place and have the right mix of businesses. I can’t see Memorial City Mall failing any time soon. I may be wrong.

Oddly enough I’ve been to three malls in the last month after not going to any for a couple years.

I went to memorial city. Traffic inside seemed kinda light but wasn’t bad.

Stopped at Greenspoint last month…OMG…is a ghost town. It’s only partially open.

Willowbrook mall seems to be doing just fine.

A big Mall on Tucson’s west side just closed and was demolished. A housing development taking its place,

Mall was over 30 years old. Not rundown.

There is one on Broadway, near U. of Arizona campus that is suffering from declining business.

Did you open carry there ?

Northwest Mall, West Oaks, Greenspoint, and the demolished Town and Country all died or in the process of dying. Guess Northline and

Gulfgate ( not really a mall ? ) all died too.

Memorial City is my current favorite because of

the kids play areas ( 2 inside, one outside) , cinemas, and ice rink. Willowbrook is okay but

traffic seems light to me when I was there (non prime time).

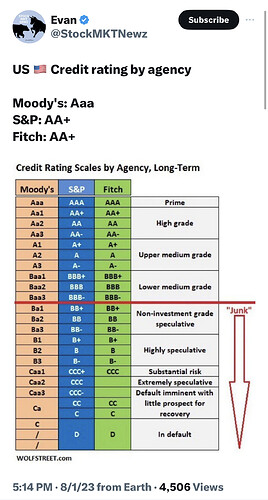

Fitch lowers US financial rating from AAA to AA+

It’s impact goes beyond the guvmint. Major holders of treasuries, insurance companies for example, will get downgrades which increases costs of borrowing.

One day stocks will drop and they’ll be all these ‘told you so’s’ while I just roll my eyes and invest more.

Report: U.S. Will Now Need A Co-Signer To Purchase A Used Ford Taurus

Aug 2, 2023 · BabylonBee.com

U.S. — After receiving a downgrade in its credit for the second time in history, the United States government has been informed by crediting agencies that it will now need a co-signer to purchase a used Ford Taurus

“If it was a Kia, maybe,” said credit analyst Rob McCormick. “A Ford Taurus though - sorry Uncle Sam. No can do.”

After accumulating $15 trillion in debt over the past decade, U.S. officials were shocked to learn about the credit downgrade. “Wow. I had no idea that spending $15 trillion dollars that we didn’t have was an issue,” said Senator Chuck Schumer. “I’m just really caught off guard that people would be hesitant to loan us even more money. I wish someone had warned me.”

Credit agencies offered a plan for the U.S. government to help repair its credit score, but reports indicate it was poorly received. “The government could, for example, try a budget,” said Fitch CEO Larry Reese. “You know - track your income to ensure it doesn’t exceed expenses. It’s pretty radical, but there are real steps they could take.”

At publishing time, Biden had assured the American public that no one needed a budget and he could just get Ukraine to co-sign for a 2010 Taurus.

S&P 500 is up nearly 20% since this thread was started in mid-June of last year.

Can’t be true, we were going to be in a recession and the market was going to collapse.

And gas was going to $10 and the banks were all going to close.

Yep, I was singing lead or backup on that tune for a number of months and

half hoped for the market collapse that never materialized. Oh well, guess I listened

to the wrong information or just flat out processed it all wrong.! Still, I’m happy with a much better cash flow situation, so not all bad.

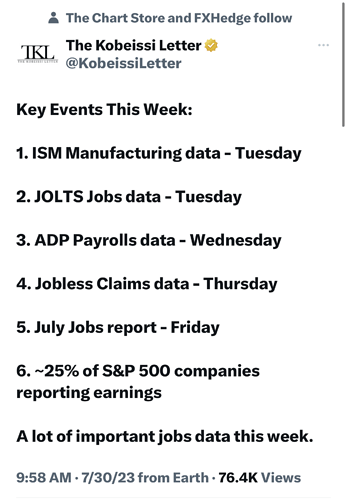

This is what I’m talking about…Jobs report out this am…

-

The U.S. added 187,000 new jobs in July.

-

Unemployment DROPPED to a near historic low of 3.5% (the lowest in more than 50 years).

-

July was the 31st consecutive month of job growth.

Headline? “Labor Slowdown Continues” … LOL

I thought we were to have the greatest depression since the 1930’s. Someone not following the script. My portfolio just keep chugging along to the north.