6 very large ones.

I think the stock market is extended here, esp. the NASDAQ-100

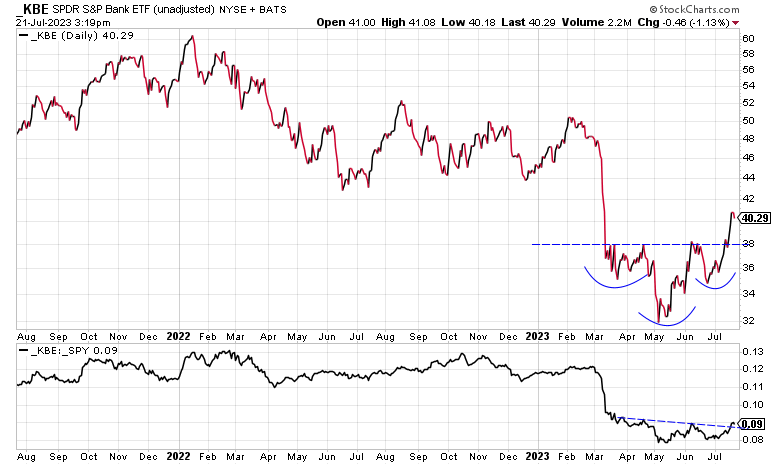

but Banks possibly putting in a bottom is a good sign, IMO.

https://twitter.com/RyanDetrick/status/1682470738882641921

I saw this article and was going to

post it! Could explain why things are still

so robust. And a reason why all those

tried and true indicators have been wrong.

Don’t know if we’ve ever had such a long period

of essentially zero interest rates and certainly

never shutdown and restarted the modern economy before. Amazing times.

The housing bubble is not as serious a threat this time as it was in the early 2000’s because of the increased creditworthiness and cash down payment requirements for buyers. The key issue in 2007-2009 was that too many buyers, even ones with great credit, simply did not have enough cash to put down on their house. As such, when the market turned, the owners were upside down.

The big issue now is that we have more qualified buyers than homes. Every time a home comes to market in my neighborhood it is gone within 30-60 days, with a few exceptions.

I think a much bigger threats to the economy are (i) Commercial Real Estate and (ii) AI. So many major business districts have new buildings going up with current buildings sitting empty, due to increased remote work. This is why so many major city mayors are asking companies to require people to come back to the office. Add to this AI rollouts and the resulting reduction in workforce, and this could devastate CRE. More importantly, the banks that hold CRE mortgages are usually mid sized banks with strong local ties (think Frost, LNB, etc.). These banks don’t have the liquidity to withstand massive foreclosures on CRE mortgages. I expect serious repercussions. The FED and Treasury are going to need to provide liquidity here and/or encourage further consolidation in the banking industry. The US has more financial institutions than any country (over 10K). That is likely too many in today’s age.

I don’t know all the details into the 2008 housing crash but I’ll go with your take on it as

another contributing factor. I do think CRE is at some risk for reasons stated. To get

employees back into the office maybe corporations will have to start offering better

on-site perks. Like really nice fitness centers and child care on-site. And on-site sports bar ![]()

I like it!!

I once worked at a firm that had an onsite Coke Freestyle Machine, Free popcorn, soft serve ice cream (with toppings bar ![]() ) and iPads and Nintendo Wii’s, plus a foosball table.

) and iPads and Nintendo Wii’s, plus a foosball table.

Yeah, as you can imagine, not much work was getting done.

So same as working from home.

![]()

![]()

The housing issue is more with multiple companies buying homes for rental including entire developments being created for rental. This creates more demand and consequent higher prices. When it turns, watch out.

Some truth here, although that is more of a landlord issue. Since most of those companies are making cash purchases, in theory it would not cause a housing bubble that would put the whole economy in jeopardy a la 2001-2007. However, it could have a serious impact on housing quality, as renters and rental owners are less likely to maintain neighborhoods. Atlanta has been ground zero for this. There have been numerous efforts by these large home rental companies (Invitation Homes, Homes 4 Rent, etc.) which are all PE backed, to buy up whole neighborhoods and then rent them out. In general, the result has been to turn once very nice neighborhoods into dumps. That is part of the reason so many are moving into my neighborhood, where homes are so expensive that the only people who could rent them make good money. It sounds sucky to say it, but its true.

-

Kudlow is a partisan clown

-

So we’re just going straight up “politics” on this thread instead of beating around the bush about it?

-

Fine by me…move this thread to the politics board

To get employees to come back to working in the office, one would think they could just say that except in unusual temporary circumstances, you are required to work in the office. If you won’t we will get someone who will. But, maybe that is too old school for the kids and they would rather sit home.

Hiring has been very difficult the last year or so. There is far more demand than supply. I’ve lived this more than once since early 2022.

The kids wouldn’t have to sit home. They’d go somewhere else and it wouldn’t be easy to replace them with equal quality. There are times when employers can throw their weight around a bit. Now isn’t it.

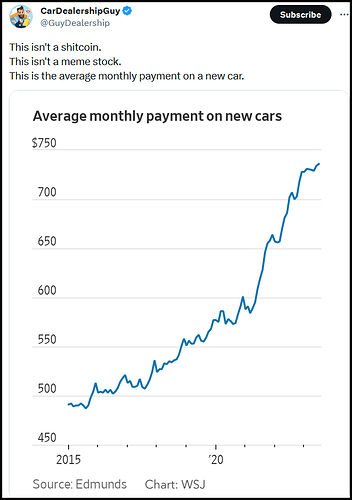

This is a bit of a deceptive graph. The line makes it look like payments doubled in three years from 2020 to now when in fact its about a 25-30% increase. Not good in just 3 years but not close to double.

C- to the graph maker.