Today I’m writing about why credit card giant Capital One is trying to buy Discover for $35 billion, which has to do with a loophole the Federal Reserve inserted into our banking laws. If it goes through, this merger will affect the relationship that millions of firms have to the payments system.

It’s an obvious point, but credit cards in America generate a lot of cash for banks. In 2022, I wrote up how the business works, with the observation that there’s something on the order of a quarter trillion dollars a year in revenue. This revenue comes from fees for connecting merchants and banks, as well as fees charged to consumers for access to credit.

Every credit card network is also a data sieve, connected to advertising data brokers, anti-fraud features, and analytics firms. In addition, being able to reject someone from the payments system is a core sovereign power, and the stated reason the right is so afraid of a central bank digital currency.

There are many barriers to entry in the credit card business, and significant pricing power among incumbents. As the Consumer Financial Protection Bureau found, margins for credit cards are persistent, increasing, high, and tilted towards the larger firms in the industry. (And this is true even when you take higher interest rates into account.)

Capital One buying Discover hits at all of these elements of the business. While the merger looks like a credit card bank buying another credit card bank - and it’s certainly that - it is more like a big tech merger, where a bank is trying to turn itself into a platform with an app store-like power over a class of customers, in this case merchants. The key quote from Capital One co-founder and CEO Richard Fairbank on the call announcing the deal was this: “The holy grail is to be an issuer with our own network.”

Here’s what Fairbank meant. An issuer, aka a bank, is regulated like a bank, while a network is regulated like a network, which includes price caps on debit cards. But thanks to the Fed, a bank that owns a network isn’t regulated at all on its network. And because of that, Capital One, if allowed to buy Discover, can set prices in ways its rivals can’t. Fairbank also made clear that’s a key rationale for the deal, as I’ll go into after I’ve explained the industry and the regulatory framework.

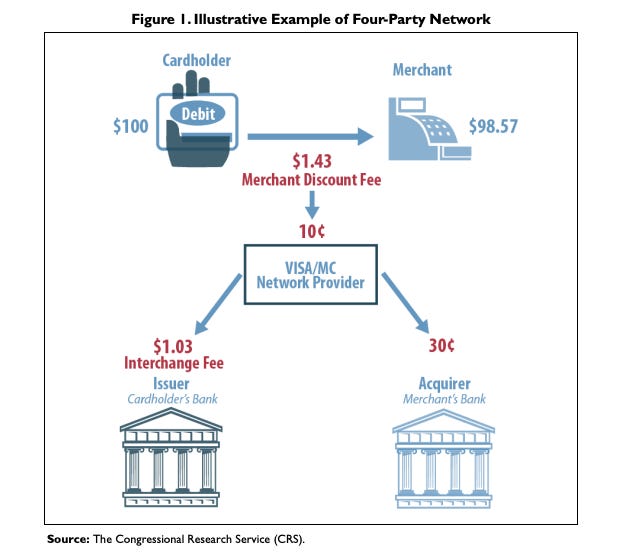

Let’s start with the basics of credit/debit cards. Banks make money in two ways. They issue cards to consumers, and charge those consumers credit card interest charges and various fees when they buy things with merchants and don’t pay the money back immediately. But banks also make money from the merchants themselves. In between the bank and merchants sits a network utility, usually Visa or Mastercard. The network operator takes a swipe fee, known as an ‘interchange fee,’ from the merchant, roughly 1.5-3.5% of every transaction, and then splits that fee with the banks. Banks send some of that money back to the consumer in the form of rewards to keep consumers locked into using that card. Here’s an illustration of how credit card networks function.

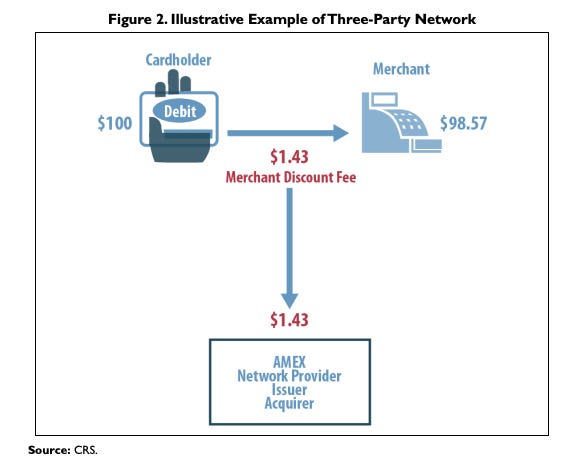

There’s a difference between American Express and Visa/Mastercard. Visa and Mastercard don’t issue their own cards, banks issue them. Conversely, banks don’t issue American Express cards, only American Express does that. So American Express isn’t a standard credit card network. It is technically a ‘three-party system,’ between consumers, merchants, and American Express itself. This distinction matters for legal reasons. (Though American Express’s status as a three party network isn’t strictly accurate, U.S. Bank does issue credit cards that operate on AMEX).

So what is Discover? Well, it’s both a normal network and a three-party system. Like Visa/Mastercard, Discover allows banks to issue Discover cards. But like American Express, it also issues its own credit cards.

So why does any of this matter? Well, America’s credit card system is a massive extraction machine for middlemen, and this merger is part of a knife-fight over who can get the biggest piece. Nowhere else in the world is there a payments system in which 1.5-3.5% of trillions of dollars of transactions goes to a set of middlemen, but that’s how credit cards work in America, much to the chagrin of merchants, both small ones and the giants like Walmart. Network fees are excessive because Visa, Mastercard, American Express, and Discover have market power over merchants, who must accept the cards their customers would like to use, even if the fee those merchants have to pay is excessive.

In 2010, Congress actually noticed this was a problem, Senator Durbin attached an amendment to the Dodd-Frank Act which regulated these networks. Specifically, the Durbin Amendment did two things. It had the Fed impose a price cap on swipe fees for debit cards, and it allowed merchants to choose among debit networks for processing debit payments. While the Fed tilted the rules as far as it could towards banks, the Durbin amendment has delivered somewhat for merchants. (The Durbin Amendment only addressed debit cards, not credit cards, and so it left out large chunks of the market. There’s now Senate legislation, called the Credit Card Competition Act, which would allow merchants to choose among multiple payment networks for credit cards.)

But the Fed also punched a hole in the Durbin Amendment. When writing the rule, the Fed went along with lobbying from American Express, and in its 2010 rules exempted three party networks from regulation, only applying it to Visa and Mastercard. And this brings me back to Capital One, whose CEO made this point explicitly on the investor call announcing the transaction. Here’s Fairbank:

The Durbin debit rules, intentionally and by design only applied in networks like Visa and MasterCard who negotiate with merchants on behalf of thousands of banks, including negotiating terms and pricing. Discover like American Express deals directly with merchants without an intermediary. They are both the issuer and the network, so there is nobody in between. The Durbin debit rules were written to explicitly exclude networks like discover and American Express.

Fairbank also noted that their intention is to move Capital One’s debit portfolio immediately into Discover, though it will only move part of its credit business. As Digital Transactions Magazine put it, “Fairbank called out a pricing advantage of the planned move into debit.” After this merger, Capital One will have millions of merchants at its mercy, merchants who will have the choice to either lose customers who want to use Discover, or accept higher fees and more intrusive rules from Capital One.