JLCoog

1

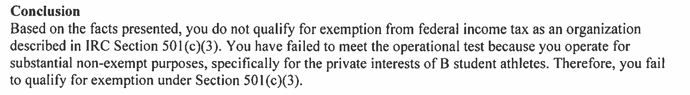

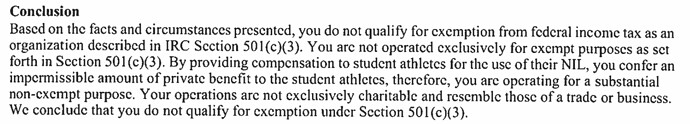

The IRS is starting to get serious about the tax exempt status of 501(c)(3) NIL collectives. Here are two denials for tax exempt status.

Full letter:

https://www.irs.gov/pub/irs-wd/202504020.pdf

Full letter:

https://www.irs.gov/pub/irs-wd/202452017.pdf

5 Likes

Still time to get those amended tax returns in for last year. Less the amount for charitable deductions of course. Can you say higher tax bracket?

I would expect most to not have exempt status in the near future. NIL is really a business expense if used as intended.

3 Likes