Same.

Audits aren’t all about being above the law or people doing illegal things. Most of tax planning is perfectly legal including things the irs doesn’t like.

The tax code is complicated and there is plenty of gray. There certainly is fraud and frivolous activities (ie illegal stuff), don’t get me wrong. That’s not the real focus here though.

Why already have record tax receipts why do we need to grow an already bloated beauracracy?

The irs has actually shrunk over the last several years. We have record tax receipts, mostly, because we have been in a bull market. That won’t last forever so it wouldn’t make since to plan for it to.

You need to be able to do audits and they aren’t doing a very good job of that right now.

Does it need to grow as much as proposed? I’m not sure that’s necessary. They do need to be doing more right now even if I’d rather they not personally.

I have no problems with $ for modernization. But why do we need so many more people? When IT department try to get more efficient they add more automation not people.

After a couple of audits a few years back (got “good” letters both times), let’s just say that some auditors are not the sharpest knives in the drawer.

They need more people but agree this seems excessive.

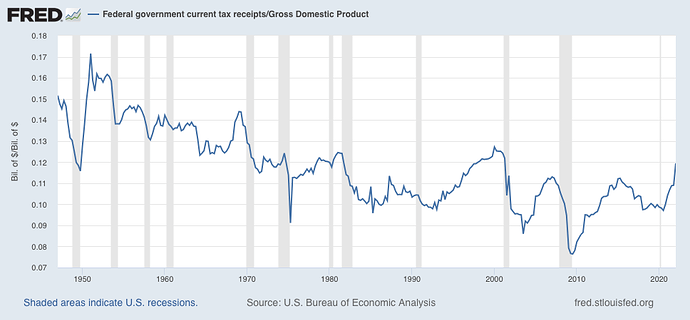

Record tax receipts in and of itself means nothing. There is no perspective.

Take a look at receipts/gdp over time

When IT department try to get more efficient they add more automation not people.

That’s a general statement and may or may not be true. In our business as we added thousands

of compute servers, HSCs, new file systems , etc …we added staff. To do audits, my best guess it

is a staff intensive process to review and conduct audits.

Audits are expensive and time consuming no matter the outcome.

That doesn’t matter to stateists who love the power of the state

Did they keep the proposed part of the bill where banks had to report transactions greater than $600

“No matter the outcome” ?

Really ?

Scenario 1, individual or corporation is abusing tax laws to skirt paying millions in taxes.

You are okay with them getting away with; they are just being a genius , right ?

I can’t believe you don’t care about the outcome.

“87,000 new IRS agents are just here to make sure wealthy individuals and big corporations pay their fair share” is the new “15 days to slow the spread.” History doesn’t always repeat itself, but it sure does rhyme.

The outcome with the IRS tends to be what they want it to be, not always what it should be. In both my audits, I had to escalate to the next level in order to “win”. Too many front line auditors are bullies who rely on power rather than knowledge to try to prove they are right.

May want to read that a little more closely.

“ to hire as many as 87,000 additional employees”

The agency’s workforce would never grow by more than a “manageable” 15 percent each year. And its total budget would increase by about 10 percent annually.

https://www.politico.com/news/2021/05/20/irs-funding-boost-489830

The move would help recoup (and go beyond) some of the employment losses the agency has seen over the past decade, as the IRS has lost more than 33,000 workers over the past decade. The drop in employment at the agency has resulted in fewer audits, particularly for filers with higher incomes.

*Both Left of center sources, not the far left or far right

In 2019 the IRS has 74,000 employees.

Yes, I think that’s about right. It’s been on a negative trajectory

since 2012 when it was about 90,000 FTEs

Says the person who has probably never received a CP2000.

How about simpler tax code and fewer ways to game the system?

Fewer audits, fewer tax lawyers (not to mention those pesky “special” interests). What’s not to like? I mean if you want to make sense and actually improve the situation, that’s one way to go.

In some countries, it’s so simple, you get a bill at the end of the year and that’s it. Like Carmax. There’s appeal but no haggling mess like we have here.

Nothing is ever truly simple. While the basic personal returns are easier in some countries, there will always be more complex tax returns (especially businesses). It’s unavoidable. It can be easier for those that have a typical w-2 and all their income is from those sources.

That said, our government also likes to incentivize (and punish) certain behaviors and the tax code is an effective way of doing so.

Could our tax code be simpler? Sure. It’s not as easy as it sounds though and something is given up along the way.

I would be for a simpler tax code. But how your transition to it, handle depreciations,

and all the special provisions we have currently ( tax deductions for energy savings, etc)

would be a daunting task.