93% of their customer holdings are uninsured.

Lots of sphincters getting very tight in the valley

Yep, and the CEO cashed out his stocks merely days before this all happened

Oh snap!

Send every corrupt exec to jail.

Gangsters are promising their mothers they’ll stay away from bankers.

FDIC insures for up to $250K, those are some rich ass customers.

Yea, that bank looks heavily weighted to the jet set

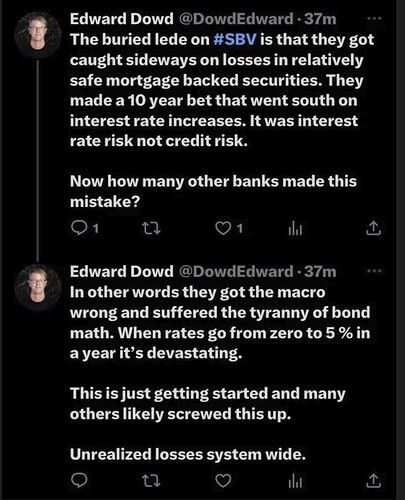

Everything is valued using a discounted cash flow. Well the rate that you are using to discount the CF has gone way up which brings the value of the asset way down. Which means all the real estate that is backing bank loans are now valued lower so as loans come up for renewal or more money is needed to by the customer, the bank won’t be able to help the customer because the collateral isn’t sufficient.

The Fed is fighting a phony war with nuclear weapons. The inflation they are “fighting” is not real in the sense that it is an overheated economy. It is structural changes that can’t be cured by raising interest rates. At first it was Covid and supply chain issues, secondly it is the war in Ukraine and manufacturers moving from China to somewhere else, then finally its the Baby Boomers retiring en masse which is causing labor shortages.

Raising interest rates isn’t solving any of those problems. In fact it is causing the baby boomers to have more disposable income because higher interest rates.

its now been one year since the fed started rasing rates, so the effects of the rate raises are starting to be felt as what happened with svb will increase and those rate raises are really going to start hitting consumers as now things like rates on existing and adjustable mortages can now be raised as its over a year. maybe a 2008 recession isnt coming but imo we are less than a year from things really taking a tumble economically.

SVB had an unusually large number of accounts exceeding the $250k insured by the FDIC. Also, it was a bank of choice for VC firms. It isn’t a typical bank.

Not to say there is no peril, but SVB is an outlier in more than one way. I’ve read they were better at relationships than at making money.

You may be right. A recession will come eventually.

That said, I’ve been hearing of the inevitable doomsday for a couple of years. There is a thread on this board showing that too. Doomsday is right around the corner. Eventually they will be right.

i’m not a doomer, the website economic collapse is there if you want that; but 40 year high inlation and personal, corporate and govts debts at or near records with rates increasing; something has to give; looks like that is starting. my wag is house prices drop 25% and unemployment goes over 7% as this resolves with a recession, anything worse would be speculation imo.

Maybe, but again, I’ve been hearing this for two years.

Always make predictions five years out.

If you are right, you look prescient; if you are wrong no one will remember.

In 2018, a bill was signed into law that lessened regulatory scrutiny for banks under $250B in assets (true). Also, capital requirements were reduced along with not having to undergo “stress tests” conducted by the Fed.

Greg Becker, SVB CEO was publicly in favor of the changes.

This isn’t about regulatory roll back. It is a bank that had too much exposure to an industry (tech) that is having problems. The Texas banks learned that lesson in the early 80s.

Then you have a classic bank run that was supercharged by technical advances. It is the first tech based run on a bank in history.

Being forced to have more liquidity may have nipped the run in the bud. Actually being stress tested may have let the bank’s owners know they faced potential problems. We don’t know for sure, but if you are convinced every bank faces the same peril, then we’d better change the banking rules to keep up.

CV says liquidity is a problem for all banks. He’s right, so keeping this from repeating too soon will require some actions, not just calming the waters. I think SVB is an outlier, but my major was Professional Writing, so I can barely add a column of numbers. ![]()

Banks have access to liquidity, either through other banks or through the Fed directly. The speed of the run is what has to be looked at. The stock market has circuit breakers that slows a market crash. I suspect some of those things will be put into place for electronic withdrawals. That is probably a smart pivot that most bankers would agree with.

But SVB was about too many eggs in one basket. Which calls into questions what the bank examiners were looking at. If banks have too much concentration in a certain type of real estate the examiners hammer them. How this got by the examiners is curious.