Why would the source be suspect?

Perhaps “suspect” isnt the best term to use here ?

I used the term source.

Endowment is a loaded term and can mean several things. I think the University of Houston System reporting on what it labels as Endowment for the University of Houston System is the definitive source, and subject to external audit. May even be

a legal thing ?

I wonder if the UH Foundation(UHF) $$$ got intermingled in, in the NACBUO report. Likewise, I wonderif the numbers reported to NACBUO come from the universities and are reported as liberally as possible to give the most favorable ranking. A little self inflation if you will, that probably all schools that participate do. However the Association does denote Texas AM Foundation monies via the footnotes, but I didnt see any footnotes for UHF being counted.

About 15 years ago they were getting about a 5% return or less than half that of the S&P500. I

think their investment choices are limited by law. Harvard, Yale and Princeton are private and make a

great deal more…

5%?

The markets have easily been producing 20% returns the last five years in just index funds.

This is why our Endowment is not growing as it should.

Yeah that is low, but I bet a lot of our investments were in oil stocks which have not performed as well.

I get the rate of return at 9.9% over last 3 years

Q2 2018 ~700,000,000

Q2 2019 722

Q2 2020 754

Q2 2021 908

908 - 700 = 208 million

208/700 = .297

.297 / 3 years = ~9.9%

And as noted, some years they took distributions of 35 and 32 million.

Edit: If you include that 67 million that was used, rate of return was over 13%.

Flaw in numbers posted: In the net numbers used, there are also some donations and contributions that make RoR look better. There is also asset appreciation and asset depreciation rolled up into that net as well. So it depends on what you look at.

Ok then that is a good growth trajectory. I wonder how much of the $208 million was from donations versus organic (ie investment) growth?

A school of our size in a city like Houston should have an endowment of $1.3 billion or higher. Cincinnati has an endowment of $1.4 billion. Granted it’s been around for 200 years, but it’s in a smaller city. So we as an alumni base as well as the business community in the Houston area need to step up.

What we do is donate $500 a year. That is less than $42/month, or less than the cost of mediocre internet. If 50,000 of our 240,000 plus alumni committed to that for the next 10 years, that would be $250 million. Imagine what could be done with that money for the students of Houston. We could offer more scholarships, fund research, improve facilities, spend on sports as well.

The numbers you seek are there in the quarterly reports; you just have to dig thru the dozen

files. My recollection was it’s mostly organic, but every now and then there will be quarter that has

larger contributions. Typically donations are in the 1-3 million range per quarter. There is also a policy document out there that goes into details of endowment investing and management. It says they plan to use 4-5% annually.

Edit: contributions - 122.3 That’s over 50% growth due to contributions ![]()

2021 Q2 12.4

2021 Q1 2.6

2020

Q4 6.7

Q3 3.4

Q2 3.5

Q1 6.9

2019

Q4 5.6

Q3 2.3

Q2 18.7

Q1 1.1

2018

Q4 10.8

Q3 18.1

Q2 29.1

Q1 1.1

For completeness, here are the distributions UH has taken from the

Endowment over last 3.5 years: 148.3 Million.

148.3 in distributions

2021 Q2 35.9

2021 Q1 1.9

2020

Q4 1.8

Q3 2.2

Q2 32.3

Q1 1.7

2019

Q4 1.9

Q3 1.5

Q2 32.9

Q1 1.5

2018

Q4 1.6

Q3 .9

Q2 .8

Q1 31.4

Over a billion now !!!

Q3 numbers just posted; mostly due to “Net Unrealized Appreciation” jump of $ 82M

University of Houston System Endowment Fund Statement of Changes in Investment Assets Quarter Ended May 31, 2021

Quarter Ended May 31, 2021Beginning Investment Assets - February 28, 2021 $ 908,632,037

Receipts/Contributions 2,375,073

Investment Income 6,421,736

Distributions (3,603,225)

Net Realized Gains (Losses) 15,759,762

Changes in Net Unrealized Appreciation (Depreciation) 82,541,155

Ending Investment Asset - May 31, 2021. $ 1,012,126,538

Looks like they are only taking out 3-4% per year from the endowment. Hopefully, they are able to grow it at 8-10% a year.

Great news for UHS. Would like to see when UH is over a billion on its own.

Renu just keeps moving forward, ever forward.

I haven’t seen those numbers recently, but a few years ago about 89% of UHS endowment

was reportedly for UH…so based on that, I’d guess the UH endowment is in the $890,000,000 range about now.

Latest posted endowment Q4 FY2021

Beginning Investment Assets - May 31, 2021. $ 1,012,126,538

Receipts/Contributions. 18,150,524

Investment Income. 3,146,210

Distributions. (2,096,135)

Net Realized Gains (Losses). 17,081,420

Changes in Net Unrealized Appreciation (Depreciation). 44,597,886

Ending Investment Asset - August 31, 2021. $ 1,093,006,443

Looks like our Q1 2022 System endowment numbers are down $10 million mostly due to taking $37.5 million distribution. From $1,093,006,443 to $1,083,666,106

Beginning Investment Assets - August 31, 2021

Receipts/Contributions

Investment Income

Distributions

Net Realized Gains (Losses)

Changes in Net Unrealized Appreciation (Depreciation)

Ending Investment Asset - November 30, 2021

$

$

Market Value

1,093,006,443

2,767,465

4,257,780

(37,569,352)

25,333,768

(4,129,999)

1,083,666,106

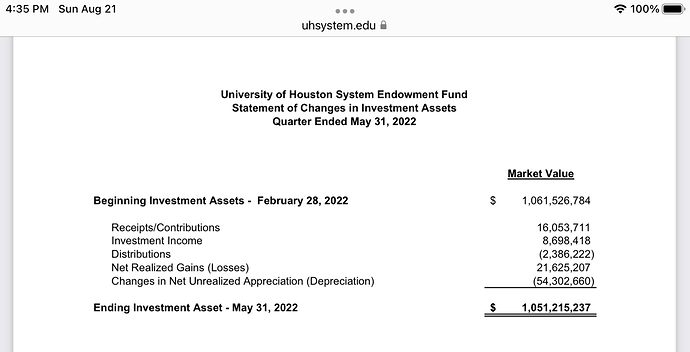

Q2 2022 Endowment posted at $1,061,526. Down about $22 million, but contributions up to $11 million. Investment income about flat at $2.3 million.

University of Houston System Endowment Fund Statement of Changes in Investment Assets Quarter Ended February 28, 2022

Beginning Investment Assets - November 30, 2021

Receipts/Contributions

Investment Income

Distributions

Net Realized Gains (Losses)

Changes in Net Unrealized Appreciation (Depreciation)

Ending Investment Asset - February 28, 2022

$

$

Market Value

1,083,666,106

11,718,042

2,362,745

(1,278,696)

18,957,607

(53,899,020)

1,061,526,784

They got Bobby Jindal to thank for that. Also Louisiana been is a very poor state in many regards. Long as they can puff their chest out about LSU FB there fine.

Not too bad quarter all things considered for Q3 2022. Endowment only

down about 10 million and with 16 million in contributions.

Could you explain more why it isn’t too bad losing 10M on our endowment? Is that normal?

Some of the investments are in market securities, and the quarter was down. $10 million is only

a 1% drop in value. I haven’t checked, but I’d expect other schools endowments to have dropped as well. Actually, this may point to the funds being too conservatively invested by the system. I was half expecting to see 5-10% hit. And of the $10 million drop, $2.3 million was actually used by the school.