Looks like the norm for most universities at this point. Just skimmed the article, but appears we are doing ok.

I’m late to the party here and instead of creating a new thread, I’ll continue on this one: (@NRGcoog I feel like we’re kindred spirits on a lot of things)

I’m looking at UH’s financials, where there are two organizations for the UH financial strength (endowments, given potential recession):

- UH System - As of May '22, there’s $2.2B in investments (1B of endowments + 1B of non-endowed investments + 0.2B in Bonds)

- University of Houston Foundation with $0.2B in funds under management

- I’m not 100% sure if the $0.2B at UHF isn’t already part of the $2B in UHS reporting (I don’t think it is, but I’m not experienced in non-profit, fund accounting)

Do any of y’all know who Terrylin G. Neale is ? She’s the President of the UH Foundation and on a LOT of boards and foundations in Houston. Is she a philanthropic alumnus?

How does the Houston Cougar Foundation fit in here? I assume all it supports is athletics.

Yeah, that’s sports related. I haven’t gone through the financials to find it, but it could be within the non-endowed investments.

Endowed - can’t spend the principal, but can spend the interest earned.

Non-endowned - can burn through it all - dolla dolla bills, y’all

I’ve tried to reach out to UH Foundation via email suggesting improvements in

the web page years ago, but all I got back was a polite “thank you , we will consider it”.

If you look at the Aggie Foundation, it is at another level in terms of funding and information

provided. We should do better.

As for Terrylin Neale, she has been there as president of UHF at least since 2020

per the 990 filings. Here is a link if you’ve not already stumbled across it.

I did some digging and the UH foundation was originally created to assist in the transition from UH being a private school in the 1960s to public. Its mission was updated to be a fund raising support arm for the system and institutions.

While I couldn’t find early details or an abridged biography on Terrylin Neale who is a professional fundraiser (without a LinkedIn). Mrs. Neale has been a part of the Houston civic scene since, at earliest I’ve found, the 1970s where she put on widely successful fundraising events and campaigns. She’s been a part of the UH foundation as President for quite some time, the earliest records I could find at 2013, but found records going back to 2001 of her being part of UHF (probably as President confirmed through the ProPublica 990s you gave - thanks!). Her keen focus has been on art, opera, music and theater companies. I did find that she’s a 1958 graduate of Lamar high school. In 1963, she worked in DC under Rep. Clark Thompson. Her parents (Milton and Linda Gregory) were alums of Baylor and her late father Milton was the Chairman of Baylor’s board of regents. You could imagine that they were benefactors to Baylor because there is a Milton T. Gregory garden at their Moody memorial library. One could also assume that Terrylin is a Baylor alum, but I can’t confirm. Mrs. Neale does have a room named after her and her sister, La Neil Gregory, in one of Baylor’s library (donated by her late mother).

I believe Mrs. Neale’s husband is professional investor, Dan Neale, who has been in the Houston area since the 1960s and runs the Houston Investment Corporation.

The Neales’ late son was a UHD alumnus who passed away in 2012.

Background check behind, it looks like Terrylin is plugged into connections in the city and a great leader for the foundation. The UHF endowment has grown from $57 million in 2000 to the $200 million today.

I’ve tried to reach out to UH Foundation via email suggesting improvements in

the web page years ago, but all I got back was a polite “thank you , we will consider it”.

If you look at the Aggie Foundation, it is at another level in terms of funding and information

provided. We should do better.

While I wholeheartedly agree that this website is tired, based on what I see in the financials: there isn’t a budget except for:

- Terrylin and her accounting or administration staff (3-7 people depending on the year)

- Financial advising fees from outsourced investing partners (banks, etc).

- They keeping costs down which is unfortunate because it’s not attractive, at all, for donations and doesn’t reflect well on a system with a tier 1 school.

In comparison to 4 nonprofit investment companies I’m familiar with:

- The Texas A&M foundation has 2.7 billion ($124 million given in 2021 alone)

- Has a staff of 10 highly (1-3x Terrylin) paid operations and financial investment professionals and a fleet of Maroon Coat student volunteers that just call people, everyday from the alumni directory for donations (they call me twice a year).

- UCLA Endowment - has $4.6B and $116M in 2021 donations.

- Run by the UCLA Investment Company that has a staff of 13 operations and Investment professionals (again, highly compensated)

- Rice Endowment - has $8.1B and $54M in 2021 donations

- Run by the Rice Management Company with a team of 43 operations and investment professionals

- This is a cheap comparison because Rice started life on third base.

- Texas Tech Foundation - Has $835M with $20M donated in 2021 (this is not the full endowment of Tech which is $1.69B for the full system)

- Best comparison to the UHF

- Staff of 8, but mostly employees of Tech run it and are donor relations people vs professional investment managers like the 3 above

Granted UHF is not the UH System endowment (it’s roughly 20% the size) it’s severely dwarfed in comparison to the giving and frankly, other well strategized/funded institutions. It doesn’t mean it can’t get there, but it will take a village and a very sharp representative to build something equivalent, plus a few decades.

I think with the right investment fundraiser and some UH MS Finance (Cougar Fund alums) with CFAs could raise a lot of money. UH could also look into copying USC in how they’ve turned around in 2 decades from being a fallback for rich kids to an elite school with highly focused strategies. Great lessons on corporate and philanthropic donation strategies from USC.

The other small issue is, from what I read in a 2015 article from the NYT (I think) UH doesn’t enroll > 1% of its undergraduate classes from the kids of wealthy elites. It’s very good, however, at helping kids jump social classes and becoming wealthy, but I don’t think there is that strong of an organized, donation engine to monetize it, optimally.

I’m not sure that is good sign or not. Sure

it has been paying out each year , but it

has also been receiving gifts and donations over that 22 year period. From the sites financial data it’s not easy to track or understand. You have to look at all twenty-two 990 forms to understand donations and expenditures by year and rate of return on the

principle. People like donating to winners, so

if there is a positive story there to tell, splash in

graphs across website.

You know, I wrote all the above on my phone and after laying in bed thinking about it, it’s not that great.

If UH had $10-20MM per year in gifts, that would be $220-$440MM (without 22 years of investment returns) plus the beginning balance of $57MM. Yeah, I’m going to walk back my words on this one. I wonder if anyone on their board has asked to benchmark against others. Michael Cemo was on the board at one time, and he’s not a financial slouch.

You said it, Brother. This is the case with a lot of UH web design, but there needs to be some better effort.

Okay. I did it. (Nonprofit finance is one area of my skill set). I’ll try to surmise this in my best, CFO, way:

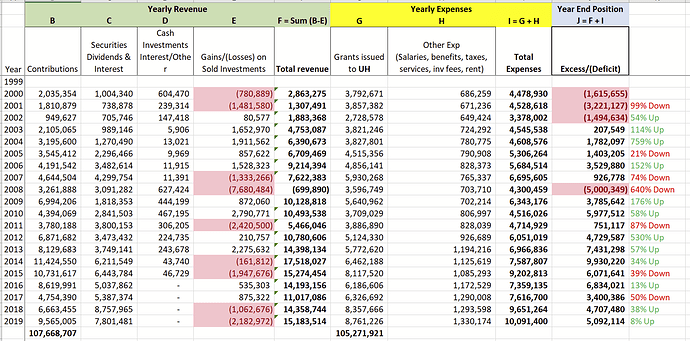

First, let’s talk yearly performance (Income Statement kind of stuff, called “Activities Statement” in NFP world)

- In almost a 20-year span, UHF has received $107MM of outside contributions and granted UH $105MM in funds.

- Note that the 20 year-span of contributions is, on average, $5.7MM in donations, per year. This doesn’t include the donations given directly to UH Main, the system, or the constituent other Universities. Which we all know has grown to a $2B (endowed and not endowed) investment balance.

- UHF took hits for the dot-com bubble in 2001, the 2007/2008 recession, and (I’m assuming, it fits well with the timing) 2015/2018-2019 downturns in the O&G industry.

- Costs have almost doubled in a 20-year period.

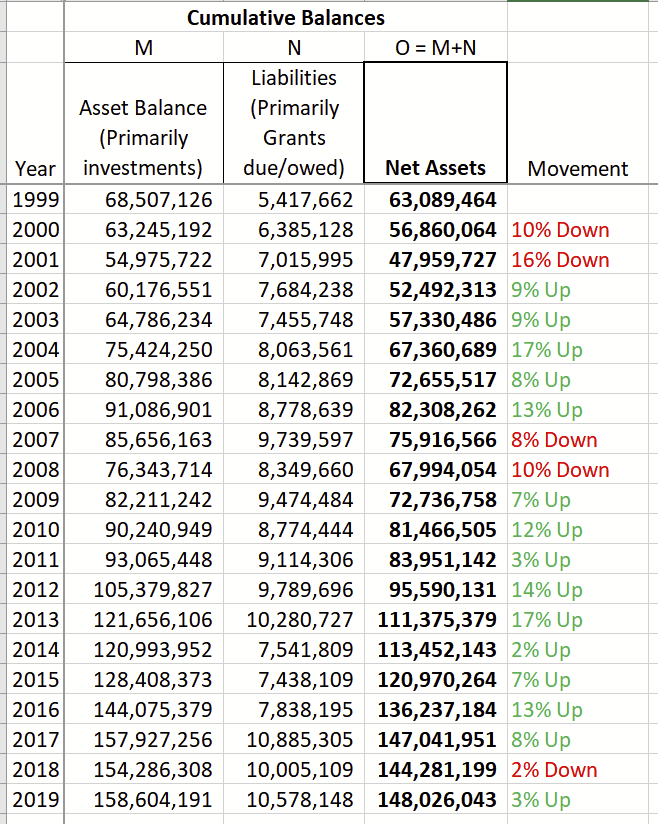

Secondly, let’s take a look at the cumulative performance of the entire fund via the balance sheet or “Financial Position”.

- Right off the bat, the fund has increased 135% since 1999.

- I don’t have the latest 990s yet, but per UHF’s website, the latest balance (Dec21) is $208MM is a 230% increase since 1999.

- The 20-year average is roughly 5% growth per annum, which isn’t bad; however, there are some significant dips that have taken this fund backwards, requiring recovery through contributions.

Third, let’s make some comparisons

If we use a benchmark model based on the Yale Endowment model (pioneered by the late Dave Swensen and widely considered the gold standard in endowment investing), their 20-year average is 11.3% growth per annum and 30-year average is 13.6% growth per annum.

That benchmark in comparison, utilizing the starting position in 1999 of the UH Fund vs what Yale’s results would provide, lead to some staggering results:

Recommendations:

- I’d reevaluate the UHF’s mission and what it would do to get there, such as moving away from a fundraising model to an endowment management corporation. I’d then start reaching out to alternative partners who can try to mirror the Swensen model (well, duh!) with 60-70% portfolio calibration. It’s a hard model to copy given that it’s proprietary to Yale, but Harvard and Northwestern have tried to do the same with decent results; however, not besting Yale.

- With this approach, it will increase the cost factors involved (different investment partners and hiring of sophisticated money managers for the UHF, itself). It’s a pie in the sky kind of transition, but it could be a valuable partner to initiate a new golden age for the UH System and slowly transition the school away from needing the PUF.

Thank you all for reading my TED talk today.

Shout-outs to @EastCoastCoog @uhlaw97 @UH1927 @TOP25 @JLCoog @zalatorg @tristatecoog

@Dan for eyes on this prize.

Great job !

Now during this period UHF started with 68M and had 107M in contributions . 68+107=175M,

We are 207M today , so we have only grown

32M in 22 years.

I agree with your recommendations.

Edit- I missed the disbursements of 105M . So growth is 137M

@Woodedge needs to be on the foundation board it seems.

Do we really need the separate UH Foundation? Is there a benefit of having it or should it be rolled up into the larger one?

Also waiting to see similar analysis on the Houston Cougar Foundation.

That’s a good question and I don’t know the answer. A&M, even with that massive PUF,

has a stand-alone Foundation as well. It seems to be not uncommon for universities to

have these separate foundations.

I’m not thrilled in our Foundations growth rate and contributions received over the last

20+ years. Woodedge gets my “vote”.

Technically, as a NFP entity, it lives and breathes one purpose: raise money for UH (Similar to the part of the mission of Houston Delphian Society). What I’ve seen in most larger Universities, is that you have at the following levels:

Top: System - controls all from an operational standpoint. Is able to communicate, strategically, with the local government and direct building of departments, buildings, etc. UC has the ultimate oversight (but the State oversees UC), like UHS, where UCLA reports the facts, figures, and financials. Think of this as the headquarters.

- This is where UH Foundation is - it serves as a fundraiser for the entire spectrum of institutions, including athletics, like the Texas Tech Foundation.

- The difference, from what I’ve found/understood is between TTUF and UHF is that UHF doesn’t have an entity nexus (person or legal relationship) connecting itself to UH. UHF’s by-laws probably specifically mention it’s only purpose is to fundraise UH

- TTUF is directly connected to TTU Lubbock’s administration; however, depending on TTUF’s entity structure, it could be protected because TTU and TTUF can have the same employees. It gets muddy and frankly, no one looks into this stuff because who would sue to see a University’s foundations books?

- Why one over the other (part of University vs separate NFP)? The difference here is that you can’t do a Texas Public Information Act request on UHF like you can with TTF, unless UHF is taking money from the state (which it shouldn’t, it’s the opposite). UHF’s books are locked outside the 990s we have access to.

Middle: The institution itself; it can do many things - raise tuition, increase student population, change how students are evaluated, build its own budgets, etc. This is the field office, at least in my eyes.

- Typically here is where an investment organization would be built and controlling an endowment, like UCLA Investment Corporation or the Texas A&M Foundation. They are employed to the corporation and a fundraising and loan providing entity, but with distance to the actual University. It keeps government out and maintains a small, focused company that can build proprietary methods of raising and investing.

Low: School colleges and departments themselves.

- This is where Houston Cougar Foundation lives as a NFP entity. I don’t have further details on them.

The gist:

The reason why it’s good to have a separate investment company is decreased bureaucracy from government, and the ability to choose one’s destiny in endowment building. It also allows for an alternative fundraising campaign that UHS may not be equipped to do (dealing with high rollers).

- UCLA’s Investment Corporation doesn’t report to the UC HQ or UCLA directly; however, UCLA’s CFO is on the board of IC. The IC does report to the UCLA Foundation (UCLA IC is a subsidiary of UCLA F) which acts as an alternative Treasury (fundraising and strategic investment finance) arm of the University’s Finance department. UCLA’s CFO has direct oversight of the general endowment, which UCLA IC provides funding towards and tangential, board oversight of the IC and F.

- Essentially, UCLA has two endowments. One under UCLA direct control and one through the foundation.

- Let’s be straight, creating an entity of outsourced investment analysts and traders make your investments more sophisticated (higher end due diligence) without the fee structure of going to your local Goldman Sachs. You have dedicated people who can mull through the BS on whether the investment is worth it or a future bomb.

- The UCLA F & IC financial books are closed to the public, UC HQ, and the state government.

Edit: TL;DR is bolded above.

All things considered, avoiding scrutiny is

seldom a good thing. I wish UHF would be

more open to sharing. Averaging $ 5M/ year in

contributions is great but without knowing the donors it makes me wonder if it is healthy "alumni donations " or something else. Is it

5,000 former students giving $1,000 each, only

a few dozen of the very wealthy, and if they have a connection to the school, or is it other

foundations ( like say Cullen Foundation, or Houston Endowment) making donations. And yes donors may want to be anonymous, which is okay , but number of individuals would be nice to know.

Then there are the other minor foundations associated with the school as well. Law school and business have their own foundations. The alumni association has one too. In 22 years they

have gone from $5M to around 9M. That’s disappointing. Business has about $55M foundation and law is at $32M

And Houston Cougars Foundation that I wasn’t even aware it existed,

The point, there are lots of entities associated with UH asking for money. That can be annoying and may not be in overall best interest of any school. But it’s hard to say a group of athletic supporters or law students or business students , etc don’t have the right to focuse on entities of their liking. It’s complex.

It’s probably a mix of the two, but from the earlier 990s, it looked like larger gifts from a small amount of donors. The new 990s don’t require contribution details like that anymore.

Given its function, the fund makes a note that it has 200 funds within the endowment that are broad in scope and purpose: scholarships, buildings, institutions, departments, etc.

Business Foundation

Law Foundation

Well done. Now you need to submit that to “turn it in” for a plagiarism check.

…Then email it all to Dr. Khator. Great job!

It guess Dr. Khator cannot really do anything directly about how

UHF manages its endowments, since it is a separate legal entity.

Board of Trustees and Staff

Nine Trustees serve on the Board of the UH Foundation. Trustees are nominated and elected for a three-year term. All Trustees have either an advanced degree from, or other close connection to, the University of Houston.

Trustees

Rob Arnold, private investor

Mike Booker, President, Financial Synergies Wealth Advisors

Paula Douglass, private investor

Rebecca Hoyt, Sr. VP, Chief Accounting Officer & Controller, Apache Corp.

Orlando Sanchez, Sanchez Partners

Alvin L. Zimmerman, Spencer Fane LLP

But she could possibly encourage UHF to seek a better return. I

wonder who nominates and who votes to elect members to the board ?

There is just so much money that has been given up when you

look at @Woodedge analysis. It is jaw dropping. Maybe we can’t get

the 11 % return but should be able to do much better then 5%.