Okay, I’m officially throwing in my towel on the hard landing and mega recession is in the

works. Any other gloom and doomers still keeping the faith ? I mean some day there will

be a recession again, but I’m not sure it will be linked to pandemic economics. Opinions?

I can see the housing price bubble bursting in the next few years and causing some serious economic effects…anytime building slows down, and all its related production, there’s going to be a recession but they’ll ramp down rates, hopefully faster than the speedy rise they did, and keep the problems to a minimum.

If it does burst it’s going to be really ugly for all those real estate investment companies buying houses to rent. They’ll be upside down and going into bankruptcy…geez…now when have we seen that before (upside down home loan issues)? Seems like it’s almost cyclical.

But…the inflation thing has played out exactly as I thought. Mostly shortage related and now that production is back price increases are coming less often.

I got last year wrong — steepest Fed rate hiking cycle in decades with 2Qs of negative GDP — I figured it had to lead to a recession.

Stan Druckenmiller thinks there are more “shoes to drop” —

Druckenmiller says a recession is on the way after more than a year of aggressive interest rate hikes from the Federal Reserve and sticky inflation. Duquesne Family Office believes a “hard landing” is inevitable. Stanley said “Our central case is there’s more shoes to drop, particularly in addition to the asset markets economically.”

https://twitter.com/WifeyAlpha/status/1678630773253984259?s=20

They’ll just keep saying that until a cyclical recession actually hits…then try to parade around like geniuses. ![]()

Yup, they will be “right” eventually.

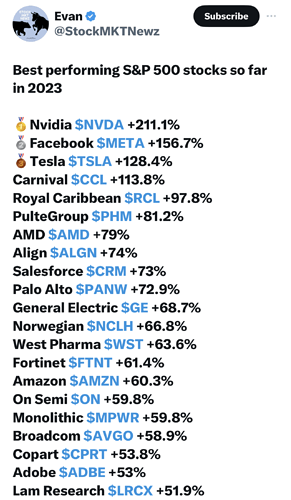

7 stocks are pushing the market up. That’s it. All AI spec.

Agree that 7 mega-cap tech stocks have driven the S&P 500 this year.

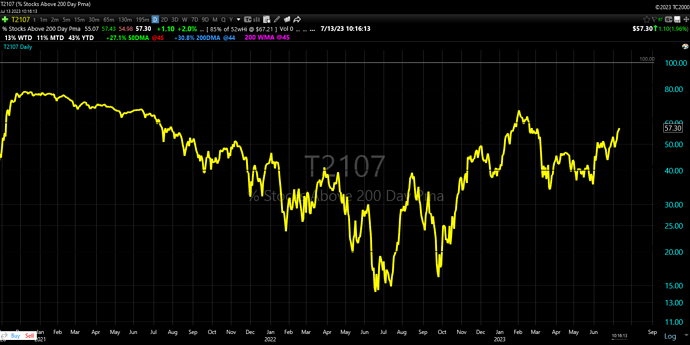

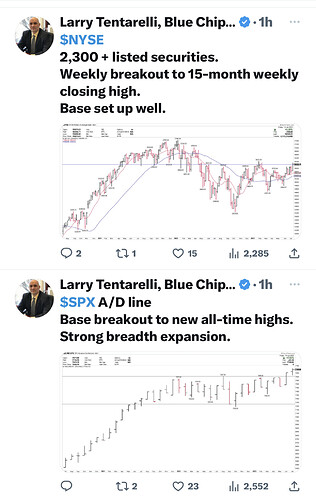

But here’s another view of things — the top chart below is daily percentage of NYSE common stocks trading ABOVE their 200-day moving average (DMA) — chart goes back to early Nov. '20

Percent above 200 DMA data bottomed last June, July at ~15% with a higher low in Sep. (that’s good). It’s been rising & is currently at ~57%.

This uptrend looks like the market is broadening to me.

Smallcaps & Value have been lagging & they seem the safe way to add here.

(click to embiggen)

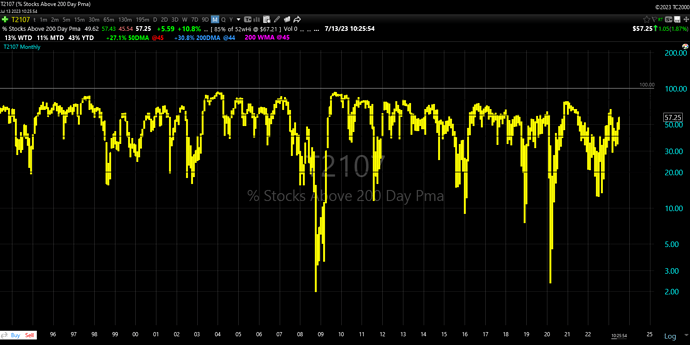

Here’s the same data but monthly back to '95. You can see it drops to only 20% every several years or so. At major bottoms like '08 & '20 it drops to about 2-3%.

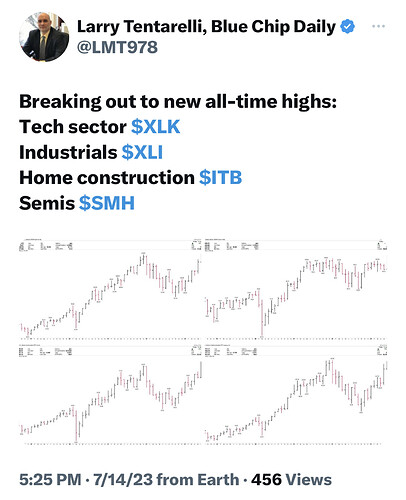

/// FRIDAY UPDATE ///

New Sector & Industry All-Time Highs

https://twitter.com/lmt978/status/1679980571848499200

But AT&T Price Return (no divs) from '94 (or '03) through today is ZERO !

https://twitter.com/CeoWatchlist/status/1679983986758565888

/// SUNDAY ///

https://twitter.com/stockmktnewz/status/1680648580091060225

(many more at link)

Reuters reports:

"JPMorgan Chase and Wells Fargo are having trouble with their commercial real-estate loan portfolios because of high interest rates and people who want to keep working at home. A McKinsey study says hybrid work could wipe out $800 billion from office-property values by 2030."

(paywall)

Something I’ve been waiting for… don’t have faith it will actually happen but I’ve not bought specifically thinking it might…Also didn’t have an immediate meed just a want if ya know what I mean…

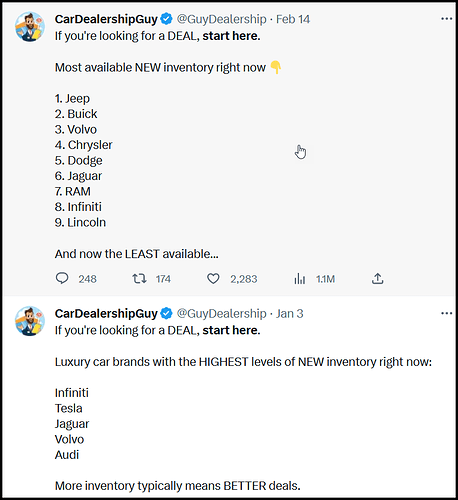

CarDealershipGuy a good follow on Twitter

Will list best rebates, discounts, highest/least inventory, etc.

https://twitter.com/GuyDealership/status/1674508285989253151

This is from February —

(click to embiggen)

https://twitter.com/GuyDealership/status/1625592300058337290

The domestics had a JC Penny sales model. The msrp was built to have a huge discount, to trick people into thinking they were getting a bargain. When COVID hit, the shortage allowed dealers to stick to msrp and even added on to it. A double whammy for consumers. Now that supply is coming back, the old normal pricing is back as well. So this isn’t that shocking a tweet.

($107B Singapore$, $81B US$)

Avocados back up to $7. Recession is back on the table.

So are watermelons

From about a month ago…

We wanted to provide you with an update on the current avocado market, as there are some important developments that may impact your orders and availability of certain sizes. As you may have noticed, avocado prices have been climbing rapidly in recent weeks. This is primarily due to growers in Mexico slowing down their harvest, resulting in fewer fruit crossings and an increase in demand. The situation is expected to intensify in the week of June 25, 2023, as triggers come into play.

Market Update on Avocados | Hardies.

We just payed $3.94 for a 5 count bag of the small Haas variety at Walmart. I’m okay with paying that; but these are still a bit green and need to ripen a few days more.

Paid $6 for a kilo in Progresso 2 weeks ago.

How many avocados are in a kilo? The $7 is a bag of five.

I joke that these are blood avocados, like blood diamonds.