Prices are high here, just not my imagination. 2nd highest grocery cost only to Miami.

https://www.chron.com/food/article/houston-texas-grocery-bill-expensive-18637227.php

More bad economic news for those seeking bad economic news.

Inflation, its definition and what it does to your wallet.

Everything is substantially higher than three years ago. Is it me writing it or is it everyone feeling it?

Inflation peaked a year and a half ago and has basically been falling since. Annual inflation inflation is now where it was at the (my fav saying) turn of the century. Stop ignoring reality.

Also, McDonalds is taking advantage of consumers who will keep buying by habit. Their costs haven’t gone up that much. Hell I just bought 18 egg for $1.49 this week. At least 1/3 of inflation has been due to excessive corporate profits. The rest has a strong energy cost component…which…

Cough cough …is being dealt with…

From January-November every single jobs report has been adjusted DOWNWARD. All were wrong.

December and January will meet the same fate. Government propaganda designed to keep the current regime in Office.

Democrats or Republicans…does not matter. B.S. numbers designed to fool voters.

Ah yes, now the conspiracy stuff starts…

BLS always refines job numbers and economic data; no need to look for something crooked in that practice that always happens.

Political words were used

I think Dec got adjusted up like 100k today, no?

Like up a full 50%+ ?

I mean, they have to do that occasionally just to throw you off the scent.

Can’t read due to paywall other than opening summary of a death spiral.

Any details of when economic armageddon hits this time ?

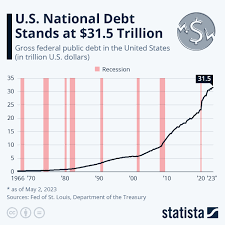

Just for discussion purposes, looks like debt has been at 99% or greater of gdp

for about a dozen years now.

| 2012 | $16,066 | 99% | Fiscal cliff |

|---|---|---|---|

| 2013 | $16,738 | 99% | Sequester, government shutdown |

| 2014 | $17,824 | 101% | QE ended, debt ceiling crisis |

| 2015 | $18,151 | 100% | Oil prices fell |

| 2016 | $19,573 | 105% | Brexit |

| 2017 | $20,245 | 104% | Congress raised the debt ceiling |

| 2018 | $21,516 | 105% | Trump tax cuts |

| 2019 | $22,719 | 107% | Trade wars |

| 2020 | $27,748 | 129% | COVID-19 and 2020 recession |

| 2021 | $29,617 | 124% | COVID-19 and American Rescue Plan Act |

| 2022 | $30,824 | 123% | Inflation Reduction Act and student loan forgiveness |

Edit - adding in other other countries numbers for context. Japan is the basket case along with

Italy, two G7 countries. As of 2024, US debt to GDP appears to be around 118% from other numbers I’ve seen, so some progress has been made (note, that concl. is not in data posted) ???

| Economy by Gross Debt | % of GDP (2023) |

|---|---|

| 255% | |

| 168% | |

| 168% | |

| 144% | |

| 123% | |

| 110% | |

| 108% | |

| 107% | |

| 106% | |

| 106% | |

| 128% | |

| 104% | |

| — | — |

| 79% | |

| 75% | |

| 74% | |

| 69% | |

| 66% | |

| 64% | |

| 61% | |

| 58% | |

| 57% |

We won’t see a lot of deflation. Prices will remain where they are for most goods and services. If some of you just want a party-branded economy regardless of the numbers, you’ll always gripe. And you do. Constantly. Most people are working and buying stuff, all of what they need and some of what they want. The people who are usually/always poor are still poor. That’s not many of us.

Housing (rent or buy) is expensive, but most of us aren’t moving this year. It’s one of the elephants in the room, and needs to be addressed.

Things can change for the worse and they eventually will. But we’ve come out of Covid pretty well.

Really?

Just keep skipping along the yellow brick road. This doesn’t end well for anyone.

“The office market has an existential crisis right now,” Barry Sternlicht, CEO of Starwood Capital Group ($115b AUM) told the Global Alts conference. “It’s a $3 trillion asset class that is probably worth $1.8 trillion. There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is .”

I’m just going to repeat this every year. The below is from last March.

In comparison, the subprime mortgage market was 600 billion.

The thread I linked to above was also about another wide scale collapse that never happened, a collapse of the banking system.

You realize how close we came in 2008 with a $600 billion subprime market to a total financial collapse?

Now we face a $3 trillion commercial real estate market while the Fed still has an inflated balance sheet left over from 2008 and a Federal goverment overspending with no end in sight.

A recession is the least of my worries