Always something about to collapse. ![]()

0% interest rates for a decade will do that

Except it hasn’t.

Yeah, so debt of 31.5 and gdp of 26.9 ; so that’s about 117-118%, which is slight improvement

over prior years. We were at 129, 124, and 123%.

The U.S. is expected to continue being the biggest economy in 2023 with a projected GDP of $26.9 trillion for the year.

Granted, debt stills “feels” too high, and is historically for the US. The trick to bring it down relative to GDP, will be to maintain a faster rate of economic growth.

As for CRE, yes I too think it will be/is the next big shoe to drop. But I view that at its core as a fundamental change in work patterns. CRE may go the way of blacksmiths and buggies when

the car became dominant. Not sure we will ever see towers full of office workers again. OTOH,

AI may make the CRE problem look like a walk in the park.

But cheer up ! Your fear of some massive new economic event is getting closer day by day. 0ne

day it will come, even if we appear to have averted the post covid mother of all recessions and

hard landing. Just didn’t happen. This time.

Inflation and its consequences:

Are you paying 20 to 30% more today than you were paying three years ago?

The answer is 100% YES.

Do people accept to pay 20 to 30% more than three years ago?

The answer is 100% NO.

What is the question , 20 or 30 % ?

30% - No, pretty much across the board. There are exceptions, but mostly drought related

items for 2 years in Texas.

For groceries, I’m probably more like 17 % for some items from 3 years ago, without

doing an in-depth accounting of personal spending on grocery items. My personal results largely align with the CPI Inflation Calculator, which is good.

https://www.bls.gov/data/inflation_calculator.htm

Jan 2017 - Dec 2020

Inflation Calculator

$

in

has the same buying power as

$1.07

Jan 2021 - Dec 2023

Inflation Calculator

$

in

has the same buying power as

$1.17

So, 17% cumulative inflation for last 3 years vs 7% cumulative inflation for 4 year

period prior. Oh, and in case you have forgotten , there was this little bug going around the

world that killed millions, created supply shortages, wreaked havoc on global supply lines and caused similar or worse inflation in ALL countries.

Any which way you put it this is devastating for many families.

I’ve brought up something similar before. You have to go really far back to get to 30%. That’s when it became 20-30% instead of 30.

In any case, that subject isn’t a great fit for this thread.

I put it at what it is 17%.

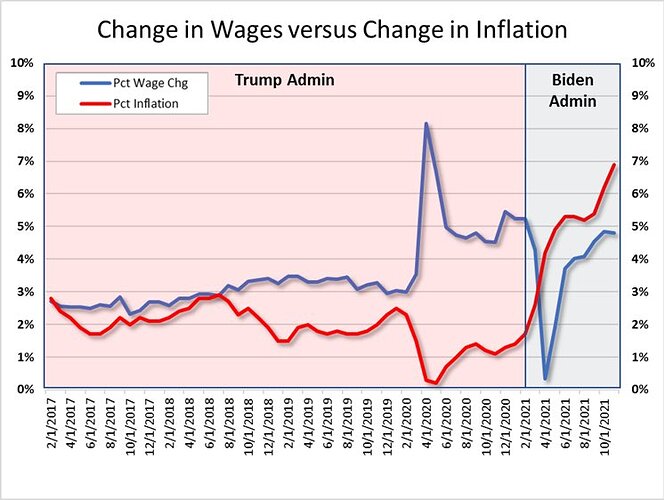

Inflation of course hits those in the lowest economic tier the hardest. As do most things in life. And if you want to have a better understanding, you have to account for wage growth during this period and the delta above

the 2% desired target. Doesn’t by no means

whitewash the lowest economic tiers plight, but to claim 20-30% is just wrong. All things considered it’s probably more like a 13% net hit actually seen, above desired policy goals.

So not sure I’d use the term “devastating” to

describe their plight, but hyperbole and exaggeration are some people’s go to thing. I try to refrain from using highly exaggerated terms, but probably have so at times as well. It’s like the misuse of terms invasion and dementia and mental illness, etc.

Wages are not keeping up with inflation and far from it. To families that are on a month to month budget that is devastating. Credit cards debt is going through the roof.

Record numbers:

Refrain? Refrain from record indicators numbers?

If you want to worry about something, worry about the Chinese stock market.

It is crashing in 1929 esq style.

Just give them a loan forgiveness like student loans.

![]()

![]()

![]()

We always have to do what is better for America first. Not depending on others is always beneficial regardless of which way the wind blows.

From the Xhitter - Bloomberg guy

Two countries can have deep trade ties without having a lot of financial ties. You can see this in trade capital flows vs financial capital flows as well. The USD is used a lot in global trade and increasingly the CNY is as well. However the USD is much much more as a share of global financial transaction denominations. This is bc the US has a highly developed financial services sector and it’s therefore more convenient to transact in USD. China doesn’t directly invest in a lot of overseas risk assets and neither does the US in China in large part fortuitously bc China doesn’t allow it. As a result China’s financial claims on the US assets (due to its accumulated trade surpluses) mostly consists in holdings in risk free assets like Treasuries or agency MBS. The US otoh has deep financial ties with other countries even if their trade volume is relatively small. Countries which host large financial centers like UK, Japan or Switzerland are examples where the financial flows (from stocks to bonds and FX) significantly dwarf their respective trade volumes. Changes in cost of capital or risk premiums in the US can directly impact demand/assets in that other countries and hence asset prices. HTH.

Blockquote

Never said they did. But if you want to understand the real net inflation impact experienced, you have to factor the wage growth in as well, rather than claiming cumulative inflation for last 3 years is 20-30 % and call it “devastating”

Wages and salaries increased 4.3 percent for the 12-month period ending in December 2023 and increased 5.1 percent for the 12-month period ending in December 2022.

Do you even understand your graph?

You choose to have political names on these graph. I did not. Why do you think one of these two individuals is 20/30% ahead on the economy vs the other?

Credit card debts hitting a new record is a huge development in our economy. This is a fact not an opinion.

This just isn’t true. The economy isn’t defined by inflation. Repeating that over and over doesn’t make it so.

Even if it were, we wouldn’t be talking about a 20-30% difference.

You are out of touch with the economy. How do you explain that the National credit card debt is at a record high? Are you going to deny this too? Due to inflation at record highs the American consumers has had to charge their credit cards to unprecedented levels. That is a fact. What interest rates are these credit cards at? Can you add one plus one? Deny all you want but National economy polls are crystal clear. It is not me writing it but the people saying it. Deny that one too all you want.