Really? Please explain

Which part? Both seem pretty clear to me.

For example, this paragraph is full of both.

Writers and analysts cannot see the picture, especially left wing rags listening to Biden about how lovely this economy is. Polls show the real score. So do the above charts.

So criticism of people that don’t do their homework is political?

If you don’t think what I quoted above is political and/or opinion, I don’t know what to tell you. When you throw in a politician’s name like that and use terms like “left wing rags,” it’s political. Be serious.

Especially given you complain about people being political on this board.

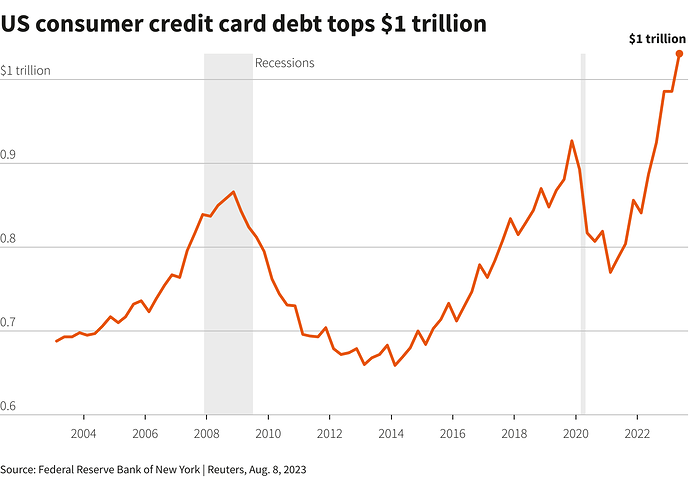

We have on 2/9/2024 a record number of credit cards debt. This is not political but facts and highly problematic. You can spin it all you want. This is a huge concern for any economist.

That’s not what I was talking about.

Some of you are painting this economy like it is a great economy. The record credit card debt is by definition the opposite of a great economy.

I don’t think I’ve ever called it great but others may have. There is plenty that points to positive. There is also parts that point to negative.

On the flip side of people painting it as great, some are quite clearly (the point of this thread) are painting it as awful and have been for years. The truth is somewhere in the middle of those two views.

Credit card is not the definition of the economy though. Just like inflation isn’t. Those are markers to be considered just like many others.

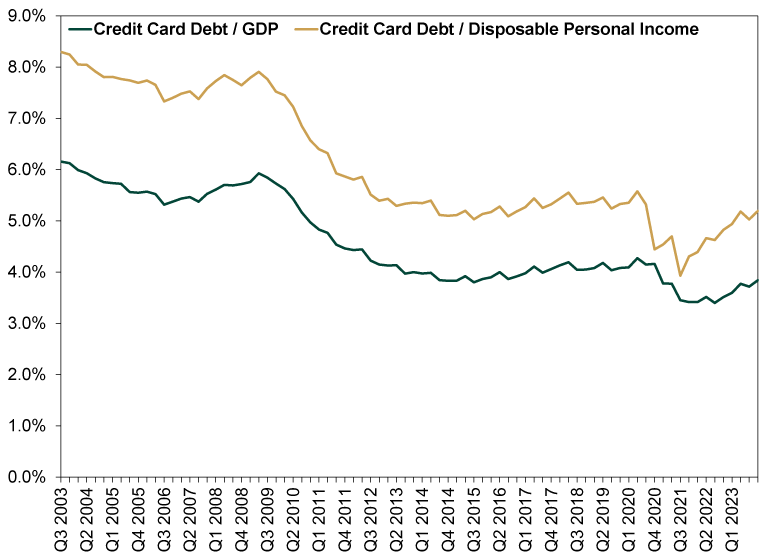

The aggregate number of credit card debt doesn’t indicate anything because it’s completely devoid of context. This is what were supposed to be afraid of apparently…

And to be clear, I do worry about credit card debt. But I also worried about it in 2019. I’m guessing you weren’t defining the economy by that (then) record though.

That is helpful context.

But…but…wasn’t the economy going crash under a certain person if elected?

My 409K is doing just fine ![]()

The “crash crowd” is working overtime on finding signals in the noise. Look hard enough

and you can find things that can scare you because you are looking for it. Hey, I was initially a part of the crash crowd and moved some amount of personal holdings to safer things. But What I left in the markets has blown away the conservative stuff.

Any way here is a kind of humorous article from Scientific American(2005) about our built in brain tendency to find clues and patterns. It’s called Turn Me On, Dead Man

Instead this was a fine example of the brain as a pattern-recognition machine that all too often finds nonexistent signals in the background noise of life.

It’s only a 3 minute read.

Not to say CRE and other sectors of the economy don’t have some real areas of concern,

but these are due to structural changes I think. Kind of like iconic Sears, the number one retailer for

years, going bust because they didn’t adapt to structural changes.

How old is this thread and how long have the same mouths on it been pitching bad news and impending doom?

A broken clock will eventually be right.

“How Old Is This Thread?”

This was originally started by @coachV in March of ’22:

When that thread veered down the climate change rabbit-hole, I started this thread in June '22 to return to the investment theme, esp. China:

“Impending Doom”

I’m fully invested right now but decades of investing experience tell me risks were & are high. I graduated from UH in ’77, studied Wall Street since the early 80s, and worked as an investment professional from ’87 to ’19. I’ve seen shite blow up over & over & over. I suspect some of the others in this thread also have decades of investing experience that tempers their perspectives, too.

Take Enron — I remember CEO Jeff Skilling coming to our offices in the fall of ’01 and confidently telling us to keep holding shares. A Value Line report on Enron written in September ’01 stated: “These neutrally ranked (Enron) shares have above-average appreciation potential.” Then on December 2nd, 2001, Enron filed Ch. 11. Shareholder Wipeout! As Enron went down, CNBC setup a large tent in front of Allen Center off Smith St. near Enron’s HQ. I would see CNBC anchors broadcasting from there as I drove home on winter evenings.

After seeing blowup after blowup, I realized they are a part of Wall Street and there will always be more of them. So, I remember these Warren Buffet investing rules — “The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”

Other folks state this idea as: “Rule #1 — Keep your losses small. Rule #2 — Never forget Rule #1.” Example: It takes a 25% return to get back to breakeven from a 20% loss, but it takes a whopping 100% return to breakeven on a 50% loss.

And others state it as: “There are old traders and there are bold traders but there are no old & bold traders.”

“Bad News” & “Broken Clocks”

I agree that recent signals that foretold past recessions have not panned out. E.g., two quarters of negative GDP in ’22 did not lead to a recession.

If I had to guess why these indicators didn’t work, I would say they were overwhelmed by our gargantuan Federal spending — In 2024, the US deficit will be nearly $1.5 Trillion. We are currently adding ~$5.2 Billion of Federal debt per day. Federal debt service is poised to become the largest item in our budget — larger than Defense or Social Security spending.

China is another matter — see Pop Quiz, next.

Pop Quiz

Following a Hong Kong court order for the company’s liquidation, Evergrande bonds are currently trading at a penny on the dollar. https://x.com/FortuneMagazine/status/1755989707140329662

What rate of return will get the bondholders back to breakeven from their 99% loss? Answer at bottom.

my Tips

Back in June ’22 the economy was slowing and the stock market was down. Folks asked about 401K investing. Here was my reply:

Bonus Question Answer: Return to breakeven requires a 9900% return

Thanks for adding that context.

That’s funny. About to be two years of gloom and doom.

The sky is falling! ![]()

I actually came to post this article…

Interesting bet from a Buffett protege. No idea what it means, if anything but certainly worthy of discussion.

The China economic meltdown is real. What is interesting is that instead of taking down the world economy it seems to be uncoupling the world economy and is actually helping the United States.

The Chinese stock market has crashed in 1929 fashion but the money that left China has been invested in the United States stock market.