Why would tariffs “drag us down”?

Nope, not based on my understanding of the definition of a recession. Would

need higher unemployment and 2 negative quarters. But with 2 negative quarters

the table is set so to speak…and unemployment can be the last thing sometimes

to show up. I’m betting NBER will not call it at this point.

Less disposable income available to consumers, less spending.

Higher taxes usually do that.

Agree, not with unemployment where it’s at.

They increase prices, reduce consumption, reduce trade, and cause retaliation by other countries.

Exports by US companies are already suffering. The absurd way these tariffs have been levied is causing a world wide issue with US goods. We can no longer be depended on. This will have long term repercussions.

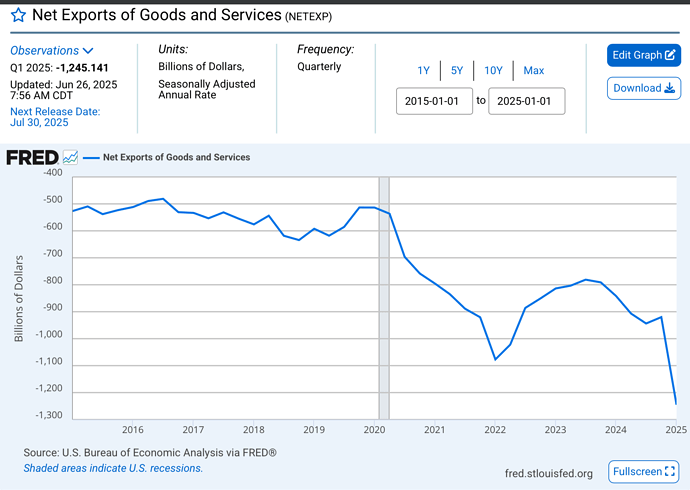

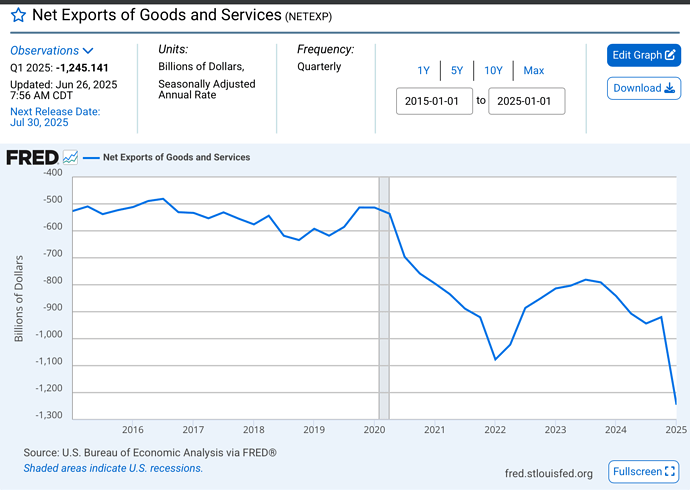

Right, I neglected the impact to our exports that will

be impacted by retaliatory tariffs. On that point people should

be aware of what our net exports looks like now. It’s ugly.

But employment is holding and markets are peaking so far. ![]()

The above chart shows a straight downward path since 2020. By $800 Billion.

This trend covers both a Democrat and a Republican Administration.

Something big is afoot here. And it probably is this: Massive Deficit Spending.

Huge sums of $money floating through our Economy with a relatively fixed amount of domestic production. So the excess money supply went to Imports.

Sound right?

I am so happy the BBB is even MORE deficit increasing policy, so much winning!!!

That’s a big part of it.

Nvm

Well there was covid that resulted in stalled supply lines for over a year and

the fact the government spent massively to counteract the once in a 100

year pandemic.

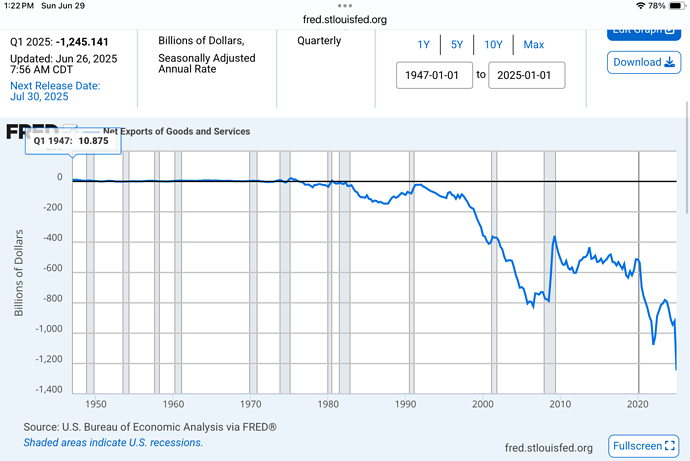

Here is the whole graph. Just another way to say we are in uncharted waters.

Q1 2025 may be so dramatic due to businesses trying to get ahead of the tariffs ?

The proposed Federal Budget continues deficit spending.

Thus Tariffs will not “level the playing field”.

Increased domestic production is required, but are we seeing that?

Hey surely these tax cuts will trickle down to us and we will all reap the benefits right?

Also a classy purely academic graphic showing how this will really work

Can you read a graph? Clearly, the downward movement (that started in 2020 under the president before Bid’n and due to worldwide Covid restrictions) reversed course in 2022.

The closest thing to a "straight downward path is THIS YEAR under the new guy, AFTER BID’N, due to the tariffs.

Fun fact: The more effective tariffs are at increasing domestic supply, the lower tariff revenue will be. It’s not a tool to reduce deficits.

But tools will argue it will end deficits, income tax, etc.

Not yet… though most people understand that US manufacturing isn’t a spigot you can turn on and off. It takes time, among other things. I believe (my opinion), there is still a lot of uncertainty on the long term tarriff situation that makes it harder for businesses to properly plan or budget their US production when they likely will still need to import raw materials/components/machinery. Obviously, different industries will be affected by that in different ways. Time will tell…

I think a big issue here is that the tariffs are being used as a negotiation tactic more than anything else. Which if that’s the goal, that’s fine. Of it’s about domestic manufacturing as they say, then there is nothing to negotiate. Can’t really have it both ways in that regard.

I don’t know; we would need to look at probably many major manufacturing

AND services industries to answer that. One problem is if you take a lot of

supposedly onshoring articles that get punched out over the decades, a lot of

them are multi year efforts and a good many seem to never meet the announced

goals or morph into something else. Almost like the companies play the officials

too to get what they want.