Keep being personal. You love doing that.

If you find this to be personal or offensive, I don’t know what to say.

Especially when you did something very similar.

Hmmm… was this not personal?

Really what is the argument you’re trying to make here? Are you trying to argue that Tesla’s earnings call was a triumph and that the subsequent stock price drop was a good thing?

How did I miss the dunking of a zipcode, again? Good times…lol

Tesla stock is fine. You want to sell your stock because it is down from a high? That is your priority. This is a good opportunity to buy Tesla stocks right now especially with the 2.o model coming. Heck I just made you a fortune.

Disclaimer:

Invest wisely.

Coogfans neither agree or disagree. Play the stock market at your own risk.

For gambling problems? Remember:

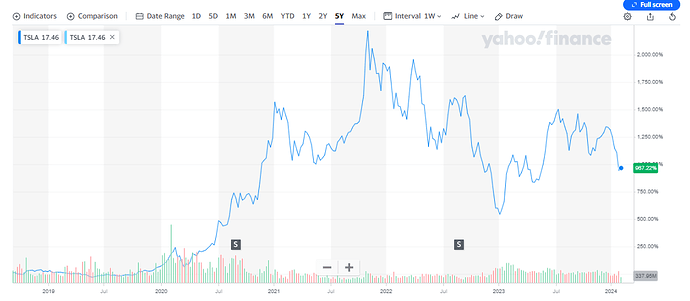

Tesla’s stock high was in 2021.

I don’t own any Tesla stock.

Would be fun to revisit this prediction in a year or two and see what the actual results are. I hope you make a fortune and donate a bunch to UH.

Ataboy

This is smack.

I thought he was just talking to himself.

Maybe we should prohibit EV threads. ![]()

And then he subsequently told me I was getting personal.

This thread was fine until the political board types showed up. Can’t you find somewhere else to go?

Suggestion? I’m all ears. With all due respect.

Tesla stock is down 54% from their peak over 3 years ago. Their PE is still high for the industry at 44 with EPS only 4.2. Their market cap is insanely high at 610B (Ford is only 47B). Telsa went on a Bitcoin like jump and got wildly over valued.

If you bought in early 2020 or before you love them. Bought in 2021-22 probably sweating from the ride and maybe wishing you sold at the peak.

Don’t get me wrong. I want EV’s to succeed and they’ve led the pack for sure. But for EV’s to succeed it really means all the other car makers have to get into that and become better competitors which means tougher days ahead for them. I have serious doubts they’ll ever justify their current market cap which is still, even after the 54% fall, based on massive future growth that might be unattainable.

So about that hydrogen.

It was a mistake for hydrogen to try and go for the light duty/consumer car market initially. I know the thought was that was the big prize, but hydrogen is much better suited currently to heavy duty transport and especially line haul with predetermined routing. But now, it’s not complete unviable but it’s getting there.

Good point.

If you can’t make it in California with a major

oil company backer, your toast for near term.

Near term being next 5-10 years.

Hydrogen is the future. They are finding huge natural deposits. The find in Albania is the spindletop of hydrogen.